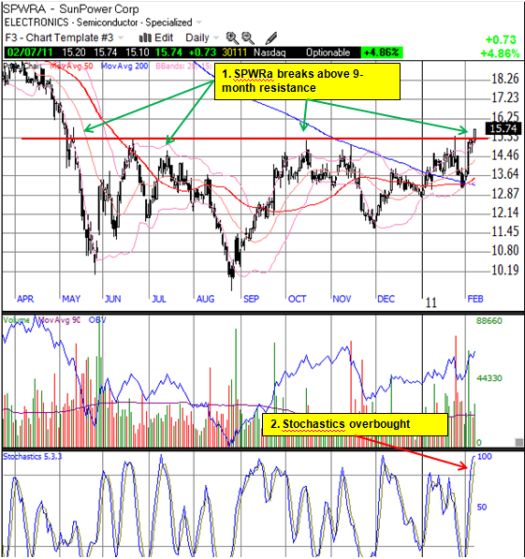

Despite my general caution on the stock market at current levels (it just flipped to overbought status on Monday), I continue to look out for bullish moves on individual stocks. This time, I found a fresh breakout candidate in the solar sector.

On Monday, SunPower Corporation (SPWRA or SPWRB) finally broke free of a nine-month trading ceiling. The move has been a long time coming.

*Chart created using TeleChart:

This breakout is happening just ahead of earnings on February 17 and could be an early sign of bullishness going into that report. The stock has become overbought and is highly subject to a fade or some consolidation before SunPower reports earnings. Admittedly, I had largely dropped SunPower from my radar after the company ran into accounting issues with its manufacturing operations in the Philippines and proceeded to lose about half its value in 2010. Now, I will be paying much closer attention.

SunPower’s stock is often interesting because of its enticingly low valuation (forward P/E = 8.5, price to book = 1.0, and price to sales = 0.8) joined with very high short interest (the 14.0 shares short are 28.5% of the float as of Jan 14, 2011). If SPWRA can report some good news or upside surprise, this combination can turn explosive as buyers rush to grab some “cheap” shares and traders scramble to close out large short positions.

In the meantime, I will continue to cling to my shares with hopeful expectations.

Be careful out there!

Full disclosure: long SPWRa

Nice call. I follow you on twitter and on SA. Not smart enough to have bought it though and now probably too late. Thanks Dr. D. Jim

Thanks for the kudos, Jim. I just call ’em like I see ’em. I wish I could tell you it’s not “too late”, but I need to review the earnings results before I say something like that! On the technical side, the stock is VERY overbought and stretched…and that’s before tomorrow’s move. So, don’t be surprised if the sellers step in relatively quickly. Should be interesting.