As the stock market continues its slow and steady creep upward, individual stocks experiencing technical breakouts are providing strong relative performance. Last week, I noted that U.S. Steel finally broke above its 200-day moving average (DMA), and it continues to barrel upward. On Tuesday, I took particular interest in three other potentially important breakouts: Whirlpool Corporation (WHR), BP P.L.C. (BP), and ProShares UltraShort 20+ Year Treasury (TBT).

Whirlpool Corporation (WHR)

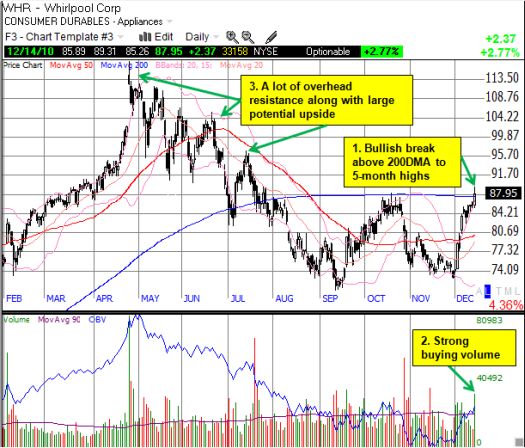

In late May, I pointed out a bullish short-term trading opportunity in WHR that worked for about a 5% gain. Since then, I assumed WHR would rally with the stock market given its robust business in emerging markets. Instead, it has languished. WHR failed to bottom with the market at the end of August, suffering a few more weeks of selling. WHR almost retested those 52-week lows in late November as investors reacted coolly to October’s earnings report. In December, the stock has turned upward for a 20% gain. On Tuesday, it finally broke above its 200DMA for a 5-month high on very strong buying volume. Heavy December and January call option activity added to the fresh bullish sentiment. The 6,201 December 90 calls traded versus 3,545 open interest was particularly surprising given these options expire in three days. If open interest notably increases, I will assume that traders are expecting a very strong move to close the week – perhaps even catalyzed by some positive news…

BP P.L.C. (BP)

I just happened to stumble upon BP’s chart Tuesday morning and noted that it was up over a point in the pre-market. BP was able to sustain most of its gains by the close, marking a very important follow-through to Monday’s breakout above the 200DMA. It seems BP is slowly but surely (and somewhat quietly) on track to regain much of what it lost over the spring and summer. It is now more than halfway there.

ProShares UltraShort 20+ Year Treasury (TBT)

On a day in which the Federal Reserve reminded us yet again why interest rates must stay low for “an extended period of time”, bond prices continued their fall (yields rose again). Notably, the ProShares UltraShort 20+ Year Treasury (TBT), an inverse ETF that performs well when 20+ year treasury bills fall in price, broke above its 200DMA for the first time in eight months. This move provides a constructive complement to the large surge following November’s monetary policy statement where quantitative easing part two was officially born. At that time, I claimed the strength provided even more convincing evidence TBT had bottomed. Since then, TBT has continued to rally more or less alongside the stock market and looks poised for further gains.

*All charts created using TeleChart:

As long as the general market provides a benign trading backdrop, these kinds of breakouts should provide attractive and sustainable upside opportunities.

Be careful out there!

Full disclosure: long WHR shares with a covered call, long a WHR call and put; long BP; long TBT; long X call spread (sold shares Tuesday)