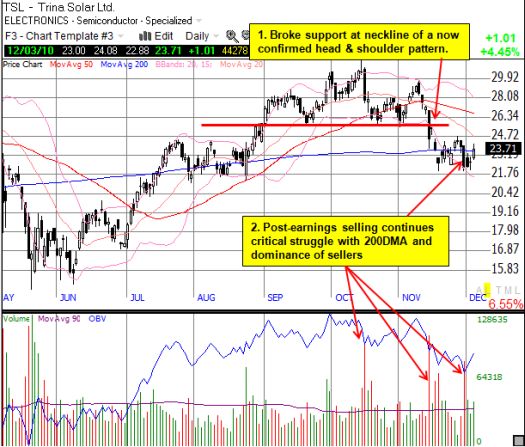

Trina Solar Ltd. (TSL) reported earnings last week with excellent headline results and strong guidance, but the stock market rewarded the company with a 7% loss on extremely high selling volume. Wedbush even reiterated its outperform rating and $43 price target based on TSL’s performance (according to briefing.com). Most of those initial losses were erased by the end of the week. I am still left wondering what, if anything, was in the earnings report that caused concern.

*Chart created using TeleChart:

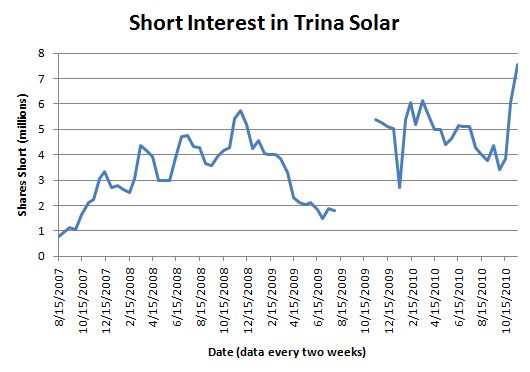

Moreover, shorts certainly seemed to anticipate bad news (or a bad reaction to the news) from the earnings report. As of November 15, shorts surged to a 52-week high and likely an all-time high (sorry, I am missing data for August to October, 2009).

Source: NASDAQ.com

I listened to the earnings conference call and reviewed the earnings report and presentation. “Investing Hobo” provides a good, detailed review of the earnings numbers on Seeking Alpha.

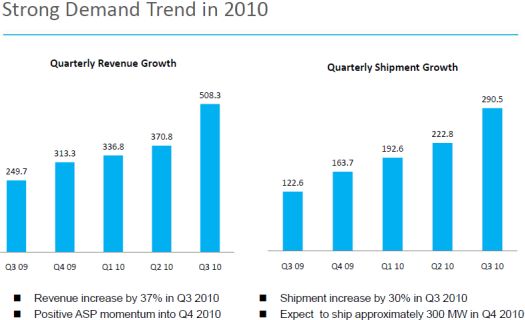

This earnings season, almost every solar-related company has reported strong results that builds from momentum from the previous quarter. Company managements have talked with various levels of bullishness about demand and the resilience of revenues relative to pricing trends going into 2011. TSL is no exception. The third quarter really stands out for TSL as shipments exceeded previous guidance of 250-260MW by over 10%. (Revenues are in millions of dollars, shipments are in megawatts (MW)).

Source: TSL Q3 2010 earnings presentation

The industry is responding to strong demand trends by ramping up capacity expansions for 2011. Investors have naturally become concerned with the sustainability of revenues and earnings under these conditions. For example, analysts pressed TSL management for information on ASP trends. As usual, management only gave directional information, presumably to keep competitors guessing about their pricing plans. Here is some representative commentary from the earnings report and the conference call:

- Expecting “…Euro denominated…ASP during the fourth quarter of 2010 to increase from that in the third quarter of 2010.”

- ASP trends in the fourth quarter will allow TSL to meet or beat its guidance: 30% margins “…based on the average exchange rate between the Euro and U.S. dollar from October 1, 2010 to November 30, 2010” and 300MW of module shipments

- ASP growth in euro and dollar terms

- ASPs are rising fast enough to compensate for rising polysilicon costs

- Flattening ASPs in major markets in Q1

- Expecting sizeable (revenue) growth in Q1 versus Q4, but no comment on specific ASPs and prices

- IF ASPs drop, TSL can compensate by managing its cost structure downward

Using the chart above, we see why analysts may be worried. Revenues per watt are down from last year and have flatlined the past three quarters: Q309 = $2.1, Q409 = $1.9, Q110 = $1.7, Q210 = $1.7, and Q310 = $1.7. This suggests that at some point in 2011, Trina Solar may need to rely on more rapid sales expansion to maintain good earnings growth. Throughout the conference call, management expressed its confidence in doing just that. In particular, TSL repeated a common theme from past earnings reports that it will use its strong brand name to expand market share. TSL is expecting “significant” market share share growth in the U.S., Australia, India, and Asia.

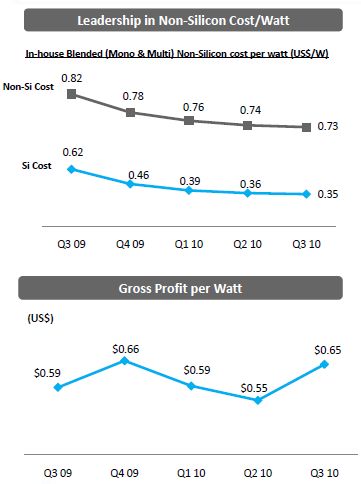

It is also possible analysts are a bit concerned about gross profits and TSL’s plans for an unbalanced capacity structure in its vertically integrated production set-up.

Over the past five quarters, TSL has consistently driven down its cost structure as it maintains one of the lowest cost structures in the industry. In the third quarter, TSL achieved in-house total costs of $1.08/Watt (in-house means completely internal production). However, the gross profit per watt is only up by 10% over this time thanks to a stellar performance this past quarter that broke a two-quarter downtrend. Again, without significant improvements in ASP, TSL will become reliant on accelerating cost reductions to turn in future good earnings performances.

Source: TSL earnings presentation

For year-ending 2011, TSL is projecting module and cell capacity of 1,700MW but only 1,200MW of capacity in wafers and ingots. Upon first glance, this lack of balance seems to make TSL vulnerable to increased costs if it needs to respond to strong demand by outsourcing wafers. Management reassured analysts on the call that it is sticking to its core competence in vertically integrated manufacturing. However, management explained that it has a wafer partner located right next door to its facility in Changzhou, China which can supply wafers if demand exceeds expectations. The cycle times for ramping up module and cell manufacturing is much shorter than the cycle times for wafer and ingot processing. There was no mention or description of the price TSL will pay for having this peak capacity made available on short notice. I am expecting analysts will be examining this item closely in the quarters to come.

Overall, TSL remains attractive on a valuation basis: a forward P/E of 6.7 and price-to-sales of 1.3 and price-to-book of 1.7. Since my basket of solar stocks is getting full, I am motivated to wait out more clarity on the chart technicals before deciding to buy TSL. For example, TSL trading back above $26 would be encouraging. A reduction in short interest and/or the appearance of stronger buying volume would also be encouraging. Failure of current support would set up TSL for a test of the $17-19 range.

Be careful out there!

Full disclosure: no positions