Prices soared for solar stocks in September. In October, volume has soared…but prices have swung sharply downward after a very strong start to the month. In most cases, solar stocks have lost all their gains for the month and then some. This trading action is creating buying opportunities, especially where uptrends and/or critical technical support remain intact. Forthcoming earnings news (which always trump technicals) and the headwinds from a potential trade dispute between the U.S. and China over green energy exports and investments will certainly generate additional volatility.

I was so struck by the surge in volume on solar stocks this month that I decided to post the charts I find most noteworthy. In most cases, the volume surges are quite dramatic. Each chart covers roughly the last seven months and are posted in descending order of Tuesday’s one-day performance. All the charts are annotated and some include additional commentary below the graphic.

First Solar (FSLR)

Memc Electronic Material (WFR)

WFR is one of the few solar stocks still up for October. It is also in breakout territory, making it a good risk/reward buy once selling calms down.

Jinko Solar (JKS)

Canadian Solar (CSIQ)

Evergreen Solar (ESLR)

I nibbled on some more ESLR on Monday’s open when the stock pulled back sharply. I am likely done scaling into the stock as I want to keep the position small until I see solid news supporting last week’s strong move.

Trina Solar (TSL)

Not shown here is that the recent highs in TSL retested the all-time highs. This failure is a bad sign, so support either at the 50DMA or, more likely, the 200DMA, needs to hold to stave off a steeper and more prolonged decline.

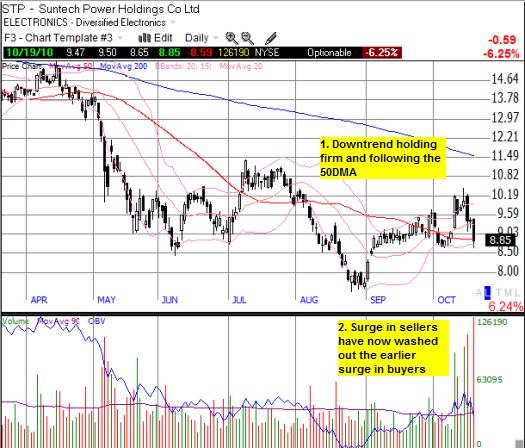

Suntech Power Holdings (STP)

STP has not been able to shake its persistent downtrend during 2010. A break of the 50DMA support will likely signal a swift retest of the 52-week lows.

Solarfun (SOLF)

GT Solar International Inc (SOLR)

Yingli Green Energy Holdings (YGE)

ReneSola Ltd. (SOL)

This pullback is SOL’s steepest since the May-June swoon. Given it is at such lofty heights (best solar performer of the year), I prefer to wait out earnings before making any buys.

JA Solar (JASO)

JASO’s steep sell-off has done serious technical damage. Some consolidation at critical support will go a long way to repairing the technical outlook. It is very positive that selling volume has remained relatively in-line with the earlier surge in buying volume.

LDK Solar Co Ltd (LDK)

*All charts created using TeleChart:

I am watching this one very closely. On October 11, LDK raised revenue guidance for the quarter from $570-600M to $610-640M and gapped up 9% before closing the day up 16%. This gap is still holding, and I will be watching the stock’s behavior at or near this gap very closely for trading cues. It is a positive sign that buyers are still “out-voting” the sellers.

Be careful out there!

Full disclosure: long FSLR call spread, long WFR, long TSL calls