For the two weeks ending August 31, short interest in Cisco (CSCO) surged 26% to 52.4 million shares (only 0.7% of float). This is close to the current 52-week high set on March 15. Over the past year, there were only two other periods that matched this recent surge in percentage terms: short interest increased 26% for the two weeks ended June 15 and a whopping 60% for the two weeks ending February 12.

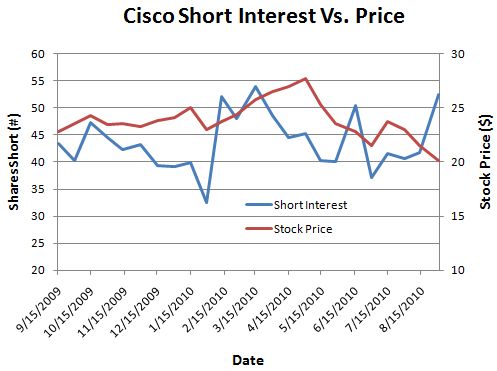

The chart below shows that there is no day-to-day or week-to-week correlation between short interest and share price for CSCO over the past year, but there are some interesting features to the relationship.

Shorts declined rapidly as the stock went nowhere in the final three months of 2009. The 8% drop from the January highs must have re-awakened shorts as they surged immediately after this. However, as CSCO began a strong price recovery, shorts eventually retreated again. The next phase of renewed interest in short positions came after CSCO had declined 18% off the high. Within another 4-6 weeks, all these incremental short positions were wiped clean again as CSCO dropped 4% ahead of a small relief rally. The current spike occurred as CSCO began a fresh post-earnings plunge in August.

In other words, although it appears the shorts in CSCO are a little more reactionary than proactive, four out of the last five major changes or trends (up and down) in short interest have been roughly correct in a broad sense. So, I consider this recent surge in short interest to be a strong red flag. However, if the stock manages to continue higher from here (like a fresh high for September), I will assume the ensuing short-term upward bias will sustain itself for at least a few weeks. I will look for a decline in short interest to confirm the potential for higher prices. Resistance from the declining 50-day moving average (DMA) is almost 8% above current prices (not shown on the chart below).

Source: short interest data from NASDAQ and Reuters

Be careful out there!

Full disclosure: long CSCO calls