This morning, Research In Motion (RIMM) announced that it completed its repurchase program through a third-party transaction (emphasis mine):

“Research In Motion Limited…announced today that it has agreed to purchase for cancellation 2.0 million of its outstanding common shares, representing approximately 0.36% of its common shares outstanding at April 5, 2010, pursuant to private agreements between RIM and a non-related third-party financial institution.

The purchases were made pursuant to an issuer bid exemption order issued by the Ontario Securities Commission. The common shares repurchased through the private agreements, together with the 3,935,800 million shares that RIM has repurchased through the facilities of the NASDAQ Stock Market since the beginning of April 2010, substantially complete the US$1.2 billion share repurchase program announced on November 5, 2009.”

Now we likely know why RIMM put the repurchase activity on hold last quarter. It appears the company had long planned to execute this deal and had to allocate a small amount of funds to complete the transaction.

The next big question is whether RIMM’s underlying bid can continue without the “threat” of further repurchase activity. As I have mentioned before, RIMM’s aggressiveness with this latest repurchase program makes me suspect that RIMM will initiate another repurchase program if the stock falls far enough (say below $65).

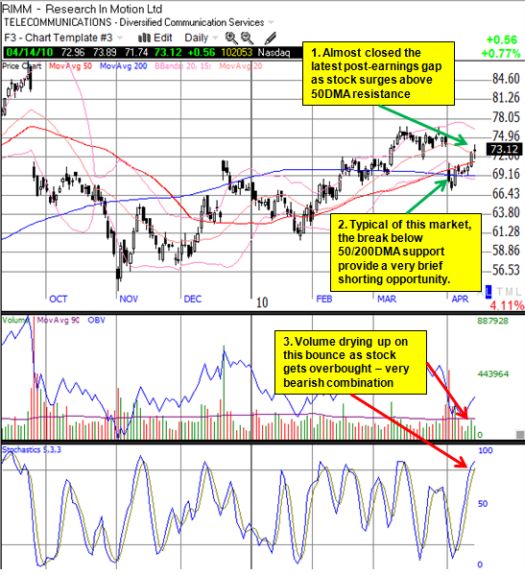

RIMM has now jumped back over important technical resistance and has resumed its climb to fill the last earnings gap. I added to the long side of the June bullish call spread on Monday (it remains essentially flat). However, shrinking volume and overbought stochastics flash a near-term warning sign. A fill of the September gap remains the intermediate-term target. The call spread remains the core position with additional trades according to short-term technicals (for example, I quickly flipped in and out of a long trade and then a short trade immediately after March 31st’s earnings call with lunch money as my reward).

The chart below shows the technical setup as of noon today:

*Chart created using TeleChart:

Be careful out there!

Full disclosure: long RIMM call spread