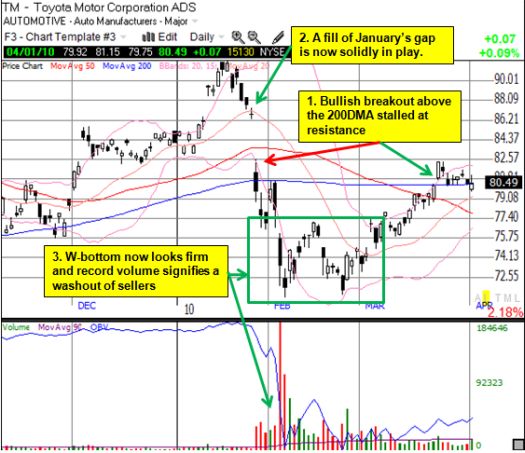

The bottom in Toyota’s stock is looking more and more firm. As U.S. auto and truck sales rose 24.3% year-over-year in March, Toyota soared 40.7% on the wings of an intensive ad campaign and generous sales incentives. While one can argue that Toyota bought future sales, these numbers remain astounding in light of the recent recall debacle. These sales numbers confirm what the stock chart has been telling us – Toyota is already in recovery mode.

The W-bottom looked firmer than ever when the stock popped above the 200DMA last week. While the stock could not overcome resistance from there, a fill of January’s gap down looks likely sooner than later.

*All charts created using TeleChart:

Weakness in the yen has certainly helped Toyota (and other Japanese exporters). The WSJ reported yesterday (“Yen Heads Lower, at Last“):

“Koji Endo, an analyst at Advanced Research Japan, estimates a rise or fall by one yen against the dollar either lifts or reduces Toyota Motor Corp.’s annual operating profit by 25 billion yen ($267 million). To put that in perspective, a 1.5-yen slide against the dollar is enough to erase Toyota’s expected 20 billion-yen operating loss for the fiscal year that ended on March 31.”

USD/JPY is now positive for the year after soaring over the past two weeks. The yen has essentially reached Japan’s unofficial target of 95 yen to the dollar (I am now looking for some kind of pullback).

Source: dailyfx.com charts

Be careful out there!

Full disclosure: short USD/JPY, EUR/JPY