The Bank of England (BoE) released its “Inflation Report” on November 11, 2009. This was my first time ever reviewing the report and watching BoE Governor Mervyn King in action as he coolly parried with reporters during the press conference covering the report.

The latest Inflation Report frequently references the benefits of the depreciation of sterling (I refer to the currency as the British pound):

- Increased competitiveness of U.K. exports

- Higher import prices that channel consumption to domestic products

- Stable overall inflation in 2009

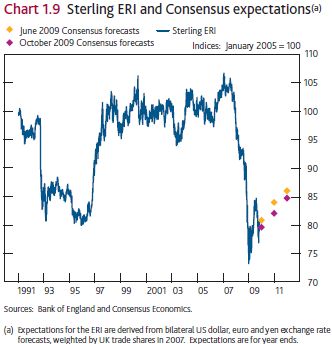

The pound peaked against its currency basket in 2007. The BoE uses that milestone as its most important reference point. However, the improvements mentioned above did not occur until after the bounce from the bottom in March of this year. During this time, the pound actually appreciated sharply, as much as 13%, and it has only come back down in the past several months. The British pound has topped out against the U.S. dollar and is stuck in a 5-month price range (see FXB for example).

The BoE also forecasts steady appreciation in the pound of around 6% over the next three years. The currency chart below comes from page 19 of the Inflation Report:

If this forecast comes to fruition, I have to believe that the U.K. will not see much more of the benefits described above (unless there is some very long lag effect from 2008’s depreciation!). Indeed, I strongly suspect that the BoE will work to prevent this appreciation (I have posted indicators that tell me the BoE wants the pound to go lower from here).

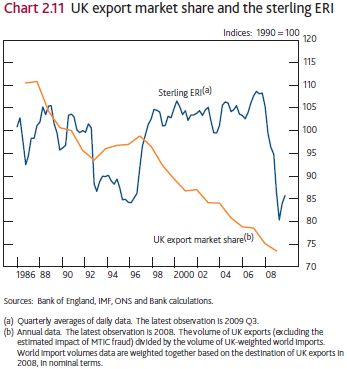

Page 25 of the Inflation Report provides a very telling chart showing the approximately inverse correlation between between the pound and the U.K.’s export market share.

Note well that the U.K.’s export market share actually continued to decline during the largest part of the British pound’s depreciation. The BoE speculates that some exporters used currency depreciation to boost profits rather than reduce prices in foreign markets. The BoE does not provided any additional insight into this apparent anomaly given its fixation on the idea that a 25% drop in the currency since the peak has driven a heaping of economic benefits. Since the data above is aggregated annually, the BoE does provide additional insight into how the relationship has played out in 2009:

“More recently, contacts of the Bank’s regional Agents have noted a modest recovery in export demand, particularly from Asian economies. Surveys of export orders have picked up a little in Q3, and, according to the CBI, optimism about manufacturing export prospects over the next year rose to its highest level since 1995. Monthly trade data for July and August also suggest that goods export volumes picked up in Q3. And there are already signs that the UK export market share may have been boosted by the decline in sterling: the cumulative fall in total world trade since the start of the recession is slightly larger than the cumulative fall in UK exports over that period.”

Again, it seems the benefits of the weaker currency are coming only after it has already appreciated and stabilized.

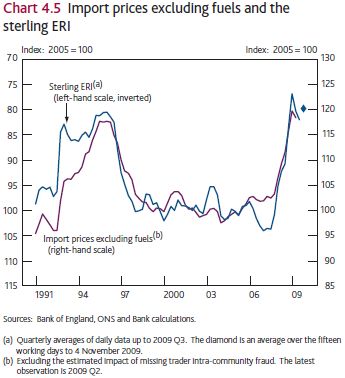

The inverse relationship between the currency and import prices is very clear and quite dramatic. The Inflation Report provides the following graph of the exchange rate in the currency reported inversely to import prices (page 35):

Page 44 summarizes the overall benefits of this boost in import prices:

“The lower level of sterling should aid the rebalancing of the UK economy. That will be an additional factor bearing down on UK imports, along with weak domestic demand. The depreciation should also boost the share of world trade that UK exporters are able to capture, although that could take time.”

Overall, it seems that there is some lag in the benefits the BoE expects from currency depreciation. Perhaps the severity of the recession distorted and delayed the typical benefits as demand across the globe contracted sharply. Either way, I believe the BoE has once again made it clear that it prefers that the pound weaken further from current levels. Governor King even emphasized that the BoE has “a complete open mind” on whether to expand the current program of quantitative easing (QE).

Finally, Governor King also addressed a reporter’s expressed concern over Fitch’s repeated threat to downgrade the United Kingdom’s AAA-rating if another major stimulus package passes. This reiteration caused the pound to fall very briefly. Governor King was quite blunt by insisting that the warnings of ratings agencies should not be taken at face value. He followed up by claiming that the U.K. is completely capable of getting its debt under control, and he pointed to the budget passed last spring that already includes significant fiscal consolidation.

An actual ratings downgrade will certainly send the pound hurtling downward, but such an event is apparently not a preferred mechanism for depreciating the currency.

Be careful out there!

Full disclosure: no positions

1 thought on “Bank of England Highlights Benefits of Currency Depreciation”