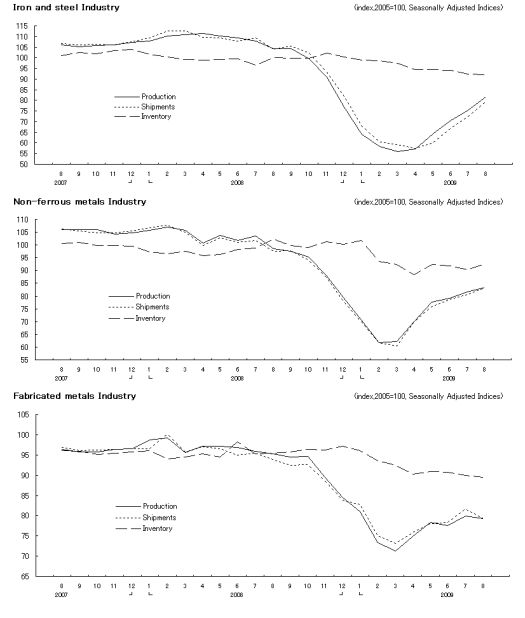

Last week, I noticed media headlines screaming the horrible news that “Crude steel output in 2009 to hit lowest level in 40 years.” As I searched for the direct source of this quote from Japan’s Ministry of Economy, Trade, and Industry (METI), I stumbled upon its “Preliminary Report on Iron and Steel, Non-ferrous metal, and Fabricated metals Products Industry.” From my standpoint, the monthly data shown below clearly demonstrates that steel production likely bottomed in March/April and is in the middle of a rapid recovery (charts copied below). So, yes, when the year is all said and done, the aggregate numbers will look terrible – as will most aggregate economic data – but the current trend seems to suggest that some kind of recovery is in place.

(Note that my article will also appear soon on “Inflation Watch“)

The price of steel rose all summer and finally stumbled again in September. On Sept 4, Reuters reported: “Chinese spot steel prices fell 2.6 percent in their third consecutive weekly fall, led by construction steel, as major mills continued to cut prices on weakened demand following a steep price run-up in recent months. After a months-long rally to a 10-month high in early August, China’s steel prices turned lower and prices of benchmark hot-rolled coil fell.” Two weeks later, the Wall Street Journal had dour news about the U.S. steel industry: “Steel Prices Drop, Reversing Course in Sign Mills Ramped Up Too Quickly.” Specifically, “Hot-rolled steel, a benchmark grade that typically is processed into cars, building structures or appliances, cost about $600 to $620 a metric ton in August. Now it can be had for about $550-$570 a ton, a drop of about 8%.” However, the article also quotes the president of the American Institute for International Steel claiming that “Steelmakers overreacted in swiftly closing steel mills last year and in early 2009…they took out too much production.” Indeed, U.S. steelmakers increased production each of the previous 11 weeks.

Overall, it seems that the recent price decline remains a hiccup amidst an upward trajectory from an ugly bottom. The evidence from this summer’s bout of price increases suggest that demand for steel is firming and customers are absorbing a myriad of price increases (including surcharges). The list below is a sample of the wide array of price increases in steel-related products from this past summer. Given the stall noted for September, October’s round of earnings announcements will be critical in determining whether the upward momentum still has legs. Until then, it seems to me that the decline in steel prices and production has been arrested for now and further increases in demand will drive additional inflationary momentum in steel.

- June 1: AK Steel (AKS) announces “…it will increase spot market prices for its carbon steel products by $20 per ton effective with new orders scheduled for delivery on July 1, 2009 and later.”

- June 18: AKS announced “…it will increase spot market prices for all carbon and stainless flat rolled steel products.” The various price increases appear comprehensive in scope and type.

- July 09: AKS announced “…it will increase spot market prices for its carbon steel products, effective with all new orders for August and September shipments. Base prices for hot rolled products will increase by $40 per ton. Base prices for cold rolled and coated products will increase by $50 per ton.”

- July 23: Nuecor (NUE) announced during its earnings conference call that it would implement price increases for the first time in nine months: “With stronger demand, we are implementing price increases in each of our products for the first time in about nine months. These stronger business conditions have continued into July. Across all of our steel mill products, we believe the catalyst for this upturn in demand is the result of service centers completing their inventory, destocking cycle.” (Seeking Alpha transcripts)

- July 23: Synalloy Corporation (SYNL) announced during its earnings conference call that “…surcharges have increased every month since May 2009, and our steel suppliers implemented a 6% price increase on May 1, 2009 and a second 6% price increase on July 1, 2009, which the industry thinks will be accepted in the marketplace.”

- July 28: U.S. Steel (X) responded to an increase in demand by increasing prices: “We have began to bring up idle facilities inline with customer demand, and we have implemented price increases in our Flat-rolled and USSE segments in the third quarter.” (Seeking Alpha transcripts).

- Jul 29: Arcelor Mittal (MT) announced during its earnings conference call that it expects increases in base prices in Europe. (Briefing.com)

- July 30: AKS announced “…it will increase spot market prices for its carbon steel products by $40 per ton, effective with all new orders for September and October shipment.”

- Aug 04: AKS announced “…it will increase base prices for all 200, 300 and 400 series flat rolled stainless steel products by 6% to 9%, depending upon the grade and product form, effective with shipments on August 30, 2009.”

- Aug 06: Gerbau Ameristeel claims during its earnings conference call that “During the quarter, we saw a stabilization of volumes as destocking by our customers appears to be slowing, as well as a firming of steel prices across all steel products.”

- Sept 01: AKS announced “…it will increase spot market prices for its carbon steel products, effective with all new orders. Base prices for hot rolled products will increase by $40 per ton. Base prices for cold rolled products will increase by $50 per ton. And, base prices for coated products will increase by $60 per ton.”

Finally, I discussed Steel Dynamics in mid-September after it raised guidance amidst general caution about the economy. At the time, I said I would buy on a pullback that I expected for the Fall. That pullback has finally arrived amidst a one-week pullback that has already taken down most steel-related stocks anywhere from 10-25%. I made my first purchase of STLD last week (and switched from puts to calls in U.S. Steel). The stock is now oversold on the “stochastics” as it hovers above the 200-day moving average (DMA). (see the chart below). I plan to scale into STLD again on Monday assuming the 200DMA holds. A violation of this long-term support will be a stark negative for the position.

*Chart created using TeleChart:

Be careful out there!

Full disclosure: long X calls, STLD

nice analysis, major players will stay around and with the recent price drop it’s a buy. one only needs cash 🙂