Cisco vs Intel

- and other stock stories (Boeing, Best Buy, U.S. Steel, and Countrywide Financial)

By Dr. Duru written for One-Twenty

January 13, 2008

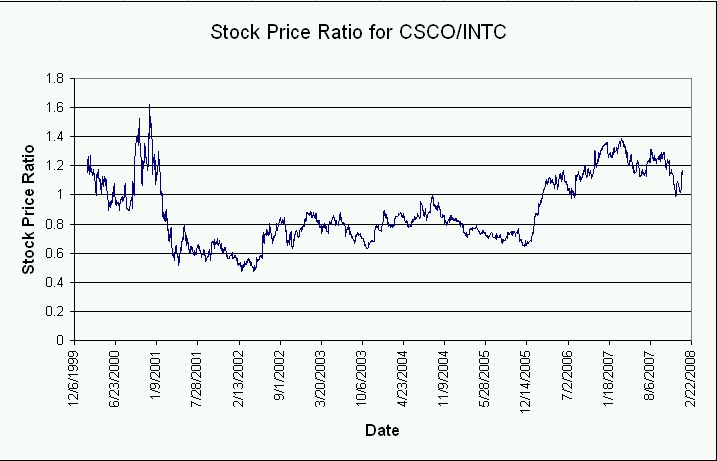

Last month, I was surprised to see a divergence in the stock performance of Intel (up) and Cisco (down). At the time, I figured Cisco (CSCO) had to catch up. Instead, Intel (INTC) dropped to join its tech big-cap cousin CSCO in the dumps and below the 200-day moving average. Now that CSCO has lost "only" -4.4% this year and INTC has lost -17.5% for the first two weeks of 2008, I decided to draw up the chart comparing the prices of the two stocks via a ratio. It turns out that the divergence I thought I saw in late 2007 is really a blip as far as the past seven years or so are concerned. From 2001 to 2005, CSCO was the persistent under-performer. The past two years have been good to CSCO compared to Intel. So, I must stand corrected...based on history so far in this century, CSCO is not the "sneaky way" to play tech; INTC is. INTC reports earnings on Tuesday. You can bet all of techland will be watching and listening closely!

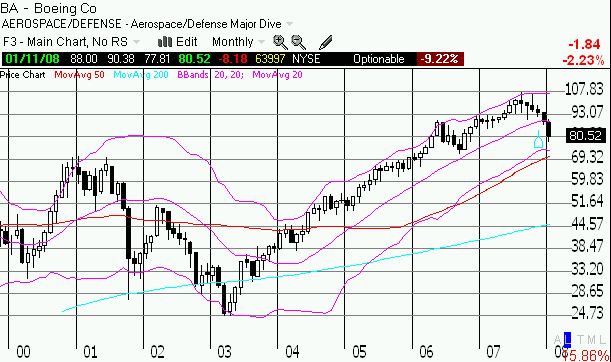

As the market tries to mark down stocks to recession-like levels, I am checking in on various stocks that used to fly high, like Boeing (BA). BA has stalled out after hitting a double top last summer and fall. It's now down 20% from its highs. The stock was on such a tear from a low in 2003 around $25 to a break to all-time highs in the beginning of 2006 that it was easy to forget that from the mid-90s until 2003, BA flopped around in a wide trading range of about $30 to $65. Well, the monthly chart on BA sure looks ominous to me; looks like a topping out. The monhtly chart below shows the expanding downside since the 2007 highs. Never in the last 5 years has BA experienced such awful monthly performance. We should of course be amazed that BA has held out so long as its American customers suffer so greatly. But it looks like the economy, production problems, and foreign competition just might finally exact a lasting toll on BA.

Best Buy (BBY) is my favorite consumer-related stock that I follow. In early December, I patted my back for buying BBY after Thanksgiving. The stock dipped into earnings, and I sold on the pop and recovery after earnings. I just did not like the way the market scrambled to get out of the way ahead of BBY's report. Turns out that those blow-out "Black Friday" holiday numbers were a head fake for the rest of the holiday season. The holiday season turned out to be a rather dismal for many retailers. And of course, BBY has been slaughtered this year with the rest of the stock market. The stock is down 16%, and it is now breaking below the important 200-day moving average. Call me crazy, but I had to start nibbling on this bad boy again (see disclaimer here). It is not that I am daring the market to be wrong about its recession fears (note that I went bearish on the market overall as of the last missive!). It's just that if we manage to avoid recession, BBY will be a stock that will soar. It is also a quality company that I am willing to bet will survive whatever economic disaster awaits us. Almost all of its serious competition has shriveled up. On Friday, BBY reaffirmed its 2008 outlook, but the market did not care, issuing another 5% beatdown. However, since I cannot time economic cycles (or the market's choices to guess about the timing), I figure I should start nibbling away at BBY now, tuck it away, and forget about it. Check in again with me at the end of this year. =gulp= I posted below the current ugliness in BBY's chart. Note that the pop in September broke an on-going downtrend. The current selling has not yet broken the August/September lows (which happened to coincide with the lows of 2006).

There are still some stocks that are flying counter to recession fears, stocks that you might normally think should be scraping rock bottom. One such stock is U.S. Steel (X). On Thursday, KeyBanc Capital Markets upgraded U.S. Steel from "buy" to "aggressive buy" with an impressive $135 price target - about a 35% gain from Wednesday's levels. The stock has an apparently low price-to-earnings ratio (P/E) of 11. But over the last 10 years, the stock has only traded above this level twice on an average, annual basis. So, we might consider this stock "expensive." Note well that General Motors (GM) is a significant customer for U.S. Steel. Given that GM's business has been in the dumps for a while and getting worse, I have to believe that U.S. Steel is "recession-proof" to consider buying at current price levels, not to mention anticipating a 35% gain in the near-future! Of course, back in July, 2005, I pounced on the technical breakdowns in many steel charts to announce potential bubbles bursting in steel. Since then, U.S. Steel has more than tripled. Wow! I clearly missed something big back then. While I will be forever grateful that U.S. Steel bought out my position in Lone Star Technologies at a nice premium, I cannot get excited about buying back into steel at these levels. But I think the chances are high for some kind of big move from here: either I am missing something again or I am right to be wary. I bought out-of-the-money calls and puts as my money in the mouth. We'll see...

I will close this missive out with a big kudos to the CEO of Countrywide Financial Corp. (CFC) Angelo Mozillo as he bails out of his dying company with the potential to earn at least $150 million in severance pay. Mozillo spent a lot of time in front of the press last year reassuring the public that all was fine with his company. Even after Bank of America shoveled $2 billion into CFC's mortgage inferno last August, he insisted that "...there was never a question about our survival...that question was only raised with journalists" (interview on Nightly Business Report). Nice! It must be great work if you can find it.

Be careful out there!