The sub-prime mortgage market continues to implode. Normally, I would sit up and search for the value in the collapse of the sub-prime lenders. I would note that the accompanying high-volume selling in housing stocks smacks of fear overdone. I am sure there are some big and deep pockets out there who will cash in handsomely on the growing disaster in residential real estate. If you are not one of those lucky folks who can buy in and wait things out until the next housing boom, read on....

Folks are selling housing-related stocks hand-over-fist for the first time in a long-time, and the selling has finally broken the back of the reaction rally this sector has enjoyed since the summer 2006 lows. Bad news is being treated like bad news and not good news now. The homebuilder's index, XHB, has cracked back below the 200DMA and only two of the homebuilder stocks I follow remain precariously strung out above their respective 200 DMAs: WCI and BHS. Both are relative small-fry. In the meantime, LEN, KBH and TOL have finally given up and dropped below their respective 200DMAs while DHI and RYL have made more convincing cracks of support than the first nicks this past Friday. It sure looks like fear has gripped the scene until you look around and see that the market is not yet ready to connect the dots.

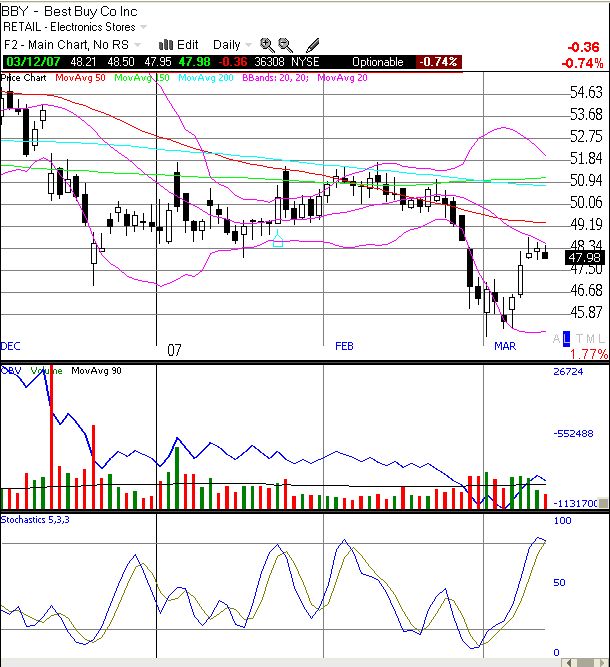

The rest of the market blithely meanders upward in a half-hearted grab for stocks "on sale" after the recent sharp sell-off. The low volume buying should serve has your first warning that this recovery is not something to celebrate just yet. I always like to pull up a chart of Best Buy (BBY) as a partial tell on the market's opinion on the consumer's prospects. BBY relies on discretionary spending, and this will be the first to go if the consumer does indeed get squeezed. The chart below shows that BBY has some of the technical trappings of a short: the stock has been in a downtrend since October (on its way down back to support about a 15% drop away), and has now tried to bounce from recent lows. It has slowed up right below the 50DMA and 20DMA with stochastics right on the edge of being over-bought.

Interestingly enough, even the VIX seems like it is perched right on the edge of trouble and poised for pain. Given that most of the past spikes in the VIX have eventually ushered in higher stock prices, I do not want to overdo the bearish significance of this chart. But it sure seems like we are due for at least one more big move upward in volatility very soon. Especially since the VIX has been flittering back to earth ever so slowly but surely. And given how low the VIX is compared to even recent history, I suspect the next spike in the VIX will be bigger than the last (the implication being that the next sell-off will also be deeper than the last).

So, the bears are licking their chops as all the dire warnings about over-leveraged consumers seem ready to swamp the economy in woe. Doug Kass waxes poetic again in "Subprime's Siren Call," and my favorite perma-bear Bill Fleckenstein reminds us yet again that he told us so in "Next: The real estate market freeze." It seems the only remaining question is when, not how or if. Certainly, I became a convert after I noted in early February the ugly, persistent, 25-year downward trend in savings rates that seem to have conveniently propped up the bull market during this same time period. It would seem to be more than just a poetic coincidence if the market made a siginificant top here just as the savings rate has turned negative for the first time since the Great Depression. Of course, if this looming calamity does begin to weaken the consumer, the Fed could always re-grease the skids on interest rates and continue the long-term decline in interest rates. It would be yet another time-tested attempt to prop up the economy with more cheap money and easy credit. It would also be a great time to grab for gold and other commodity stocks (hard and real assets over phoney money!).

So, can the consumer beat the rap again? Perhaps, especially with more assistance from the Fed. For now, the Fed is probably happy to see the market get serious about risk again. It probably does not need to tighten as I have been promoting for some time now since lenders are finally tightening up credit back toward more sober norms. But I also do not seen any positive catalysts on the near-term horizon. Gas has been going back up in price, but we have seen that gas can fluctuate in a very wide range without much of an impact on overall consumer spending. We have all the makings for some serious earnings disappointments next month. Stay tuned...and be careful out there!