(charts posted at the bottom)

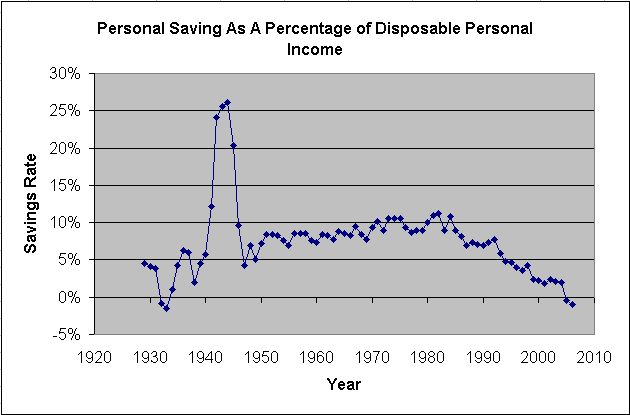

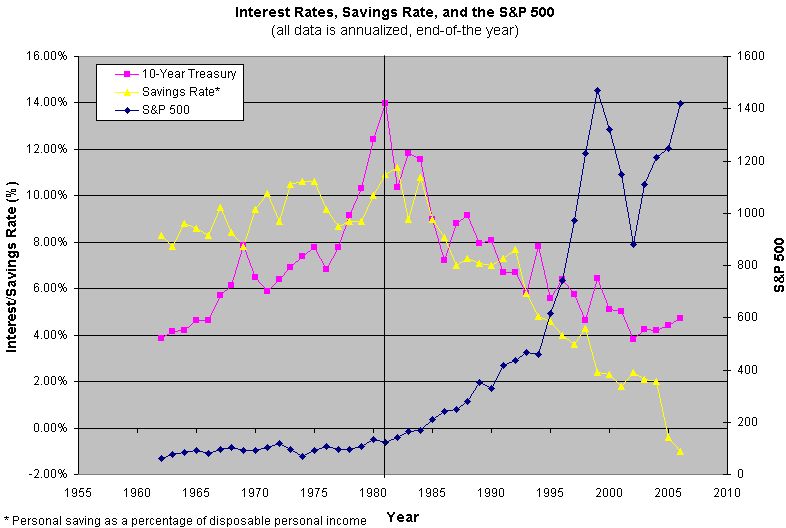

The U.S. Commerce Department recently reported that personal saving as a percentage of disposable personal income went negative for the second straight year. After I read an article stating that this rate was last negative during the Great Depression, my alarm bells rang and drove me to dig further. What I gathered suddenly put 25 years of the great American bull market into pristine perspective! The charts below should be self-explanatory, but I will spell it out anyway. In the post-World War II era, Americans were generally diligent savers and managed to squirrel away ever-increasing amounts of their disposable income. Then, suddenly, the trend was abruptly broken in the early 1980s. Americans have yet to recover. In 25 years, we have driven our savings rate under zero for two consecutive years - something unprecedented in our post-Great Depression history. When we overlay charts of the 10-year Treasury rates and the S&P 500, our whole economic history of the past 25 years suddenly makes "sense."

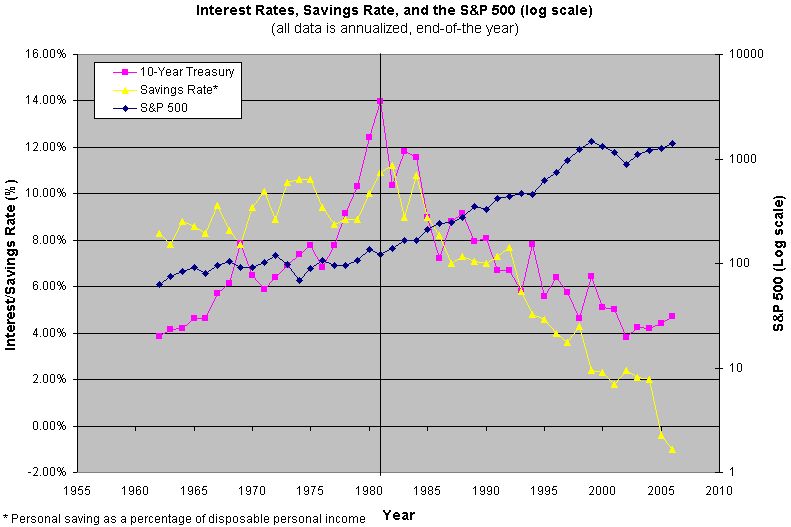

The great bull-market began with a peak in interest rates around 1981. The subsequent, persistent decline in long-term rates has encouraged Americans to save less and spend more. This spending has helped to drive the economy to the tune of a tremendous surge in the stock market for the past 25 years. It is probably no coincidence that the S&P ran to bubbilicious proportions at the same time the savings rate reached historic lows. It is probably also no coincidence that the S&P 500 has only dared to re-test those historic highs as the savings rate has taken another historic nosedive under 0%. In other words, we have only been able to squeeze more life out of these fumes by pressing the pedal to the medal - spending everything we make and now dipping into savings as well. Anyone want to guess what will happen once the Fed finally gets serious about driving rates back up? Or guess what will happen when consumers finally realize that they cannot build debt forever and/or finally run out of savings -- and they start becoming diligent savers again?

My apologies to the bears who have already been hip to this data and the implications for some time now. I guess it is better now than never for us late-bloomers. Given the good economic numbers that continue to come out these days, I guess I cannot go back to being a full bear just yet. But consider this missive as the moment Dr. Duru finally gets back on the long-term bear bandwagon. This picture of interest rates versus savings rate versus the S&P 500 makes for excellent background wallpaper to the warnings Federal Reserve Chairman Ben Bernanke served up to the Senate a few weeks ago about America's looming federal budget crisis. It also makes clear why the market, and many pundits, are so desparate to see lower interest rates. Lower rates is all we have had for so long that this is all we know. Until the repo-man returns for his due, I guess we should enjoy these "good times" for what little they are worth.

(Savings rate data from the Bureau of Economic Analysis, Personal Income and Outlays. I downloaded the annualized data from Table 2.1. Personal Income and Its Disposition.)

Be careful out there!