Negative news finally got some real selling going on Google's stock (GOOG) yesterday (Monday). The bad press came from the Wall Street Journal (again) in the form of a piece questioning GOOG's growth. In an article titled "Google's Earnings Engine May Stall," Michael Rapoport points out that Google may soon start to earn less interest on the wheelbarrows of cash it has in the bank. Never mind that Google may already be planning to draw down on this cash to make more acquisitions that could theoretically spur more growth. Never mind that Google has told anyone who will listen that it expects its growth rate to slow(albeit this slowing has typically been described in terms of revenue). So, you know folks must have been looking for an excuse to sell to dropkick the stock below important technical supports on heavy volume. Ironically enough, JP Morgan raised estimates on GOOG under the presumption that it is taking market share. But on Monday, only the sellers were paying attention.

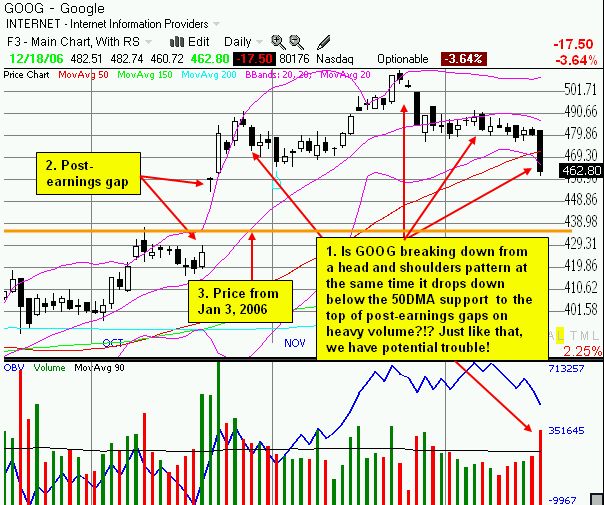

Now, today was important for GOOG's stock on many levels. Most importantly, it broke down on heavy volume below the 50DMA. It also sold back down to is closing price on the first day after the last earnings report in October. (see chart below). The post-earnings gap must now be in play. We have also reached 60 days since that earnings report. We are now well beyond the number of days GOOG has ever hit its post-earnings minimum price - at least according to the analysis I did back in November. Either GOOG is about to set a new record, or it will not go any lower until the next earnings report. (FYI - I last reported that the next earnings for GOOG will be Jan 18, 2007. Briefing.com now indicates that the tentative date is now Feb 1, 2007). When I last wrote in early November, I pondered whether it was time to buy GOOG. It sure looked like a good call (question?) since GOOG went on to make a new all-time high in three weeks. It has been a slow and steady drip back into the dangerzone since then. As I feared as the stock slowly faded from the all-time highs, the 50DMA support failed and changed the whole short-term outlook. The final important thing to note is that if the current head and shoulders technical pattern gets more follow-through, GOOG could end the year right back where it started...at $435. $435 would also effectively close the post-earnings gap. Sound like a lot of coincidences? Sure does...so it's gotta happen, right? After all, do not forget how effective of a magnet the $400 ticker proved for a year. Amazing to think that with all the fuss we make about GOOG, after all the drama rides up into celebration and down into despair, Google's stock has been making very little headway.

So, at this point, I remove my enthusiasm for the stock and will be in a "carefully watching" phase that could result in action at anytime. (I do not currently hold any positions in the stock. See disclaimer here.)

Check out the chart below for a visual and be careful out there!