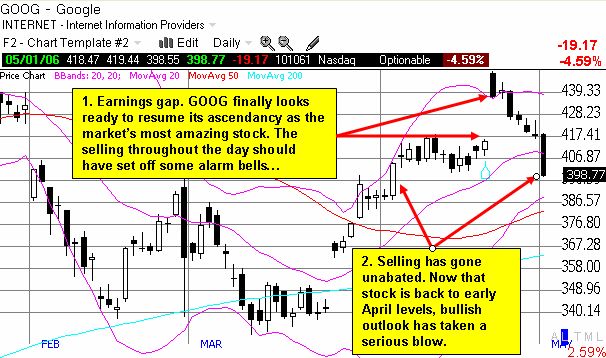

Just when you think you have something figured out, the market throws a curve ball. Once again, we find ourselves with GOOG sitting right back at the $400 target that I have talked so much about for months now. This $400 level is truly proving to be one serious magnetizing force. However, after GOOG's latest blow-out earnings report, I thought the stock was finally ready to leave that target in the dust. (See "Kramer's" take here with a $600 price target.) After seven sessions of selling practically straight down, GOOG has now cracked right through that $400 "support," and given the way it is misbehaving, it looks like the stock is ready to keep on dropping. We have now cut under thw consolidation area from April, and the 50DMA is looking like a ripe next target.

I never like it when stocks not only return all their gains from an earnings gap, but even start to revisit price levels seen right before the earnings report. This typically says that the market has now completely tossed out the window the good news and is looking forward to things getting worse...or at least not being so good anymore. To me, it represents a complete reversal in psychology. For now, I will maintain the new bullish posture from my last note, but I can't say I am happy about it. Call me a "reluctant bull." (See disclaimer here.)

Be careful out there!