I guess I have more homework to do. Early yesterday, I spent some time discussing whether the trading action on the day after Labor Day can tell us anything about trading for the rest of the year. Yesterday may have had meaning but today's ugly action probably had even more. It seems that I will need to expand my analysis to include more days after Labor Day, and, even better, look at the action over the entire post Labor Day week. (Maybe I will make that a project for 2007!). I read/saw enough mention of the continued low volume in yesterday's trading - apparently, trading does not return to "normal" levels until the Wednesday or Thursday after Labor Day. If that is the case, then the market's growing volume is speaking loud and clear about its feelings about current conditions.

In mid-August, I suspected that the late-summer rally was entering a "final phase." Last week, I followed up by guessing that the post Labor Day trade would mark the official end of that rally by giving us a nice pop on Tuesday into resistance that would get faded either mid-day or over the rest of the week. The market did me one better. First, the S&P 500 only moved up 0.17% - not even close to the 1.0 - 1.5% I was suspecting. But the NASDAQ moved right into resistance that I had almost forgotten. In early August I noted that the technology-laden index had fallen out of a two-year trading channel. The chart below shows a close-up of the old channel (upper-red line) and the new channel formed by the July lows. The straight red line in the middle marks the post 9/11 rally high of 2100 made in late 2001. You can clearly see that the Nazz completed a nice 0.57% gain only to stop right at the resistance of the former channel. (Note that Tuesday's close also just so happened to coincide with the NASDAQ's closing price for 2005). Note that it also failed to break free of this line in early July, but the action was much more sloppy than this week's. I had been looking for a challenge of the May/June highs that preceeded the summer blahs. Now I wonder whether we will get there at all anytime soon. That lower channel is looking real enticing right about now...let's say 2100 in about a month or two?

Secondly, all the vicious selling produced the predicted fade in one big swoop. Not only did we lose out on Tuesday's gains, but also we eliminated four days of gains on the NASDAQ and about five days of gains on the S&P 500. Suddenly, all the positives I cited earlier as the market's weak excuse for rallying to close the summer trading mattered not one bit. In fact, why in the world did the market sell-off today? The most unsettling thing about today's ugly trade is that it came on absolutely no major headline headwinds. Two economic reports reminded us that the economy remains as strong as ever (higher wage gains than expected and good service industry growth numbers) which in turn reminded the market that the Fed is probably not finished raising interest rates. But if the market "wanted to," it could have sold off on yesterday's inflationary news that in January Caterpillar plans to increase the prices of equipment by 5% and engines by 7%. If the economy were truly slowing down, how could such a cyclical company get away with such sizeable price increases FOUR months from now?!? You can bet that the Fed took careful note of this development, and it will continue to look for other signs of pricing power falling in the "wrong hands."

But sentiment rules and yesterday's inflation scare for whatever reason does not compare to today's. (Note that the bond market was faster to respond - the yield on the 10-year finally moved up after two weeks of continued sliding). Also note that the market took no solace in the continued decline of oil prices. Oil-related stocks got slammed on very high volume selling but that money did not find its way back to other important segments of the market. The decline in oil is starting to look like the analog of the "recession bet" that the general market experienced during this summer's selling.

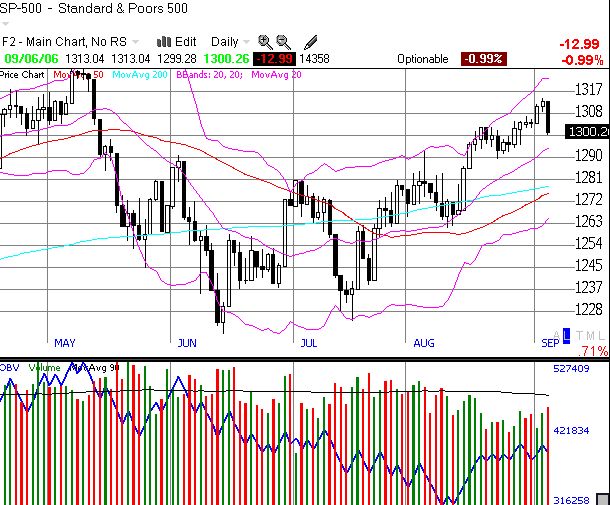

Let's conclude this tale with a review of the volume on the S&P 500. Below, I post a chart of the S&P 500 starting in late April that includes trading volume and OBV (on-balance volume). The decline in volume for the summer is a bit subtle because volume so often picked up during the down days. You can see this "distribution" of stock occuring in the form of the declining OBV. From the May highs and until mid-way through the August rally, OBV was in steady decline. The OBV remained in decline for a month as the market valiantly rallied from the July lows. OBV only recovered as the sellers finally lost interest and stopped fading the low-volume buying in the last two weeks of August (and yesterday). It seems that if volume is returning, so is the selling....

Now before you call me a bear, I should remind you that as a part of my analysis of the post Labor Day trade, I concluded that we are almost sure to end the year in the green (on the S&P 500). That means we still have 50 points (-3.8%) of cushion for the next 3 1/2 months. Most of the bears I read think that both the market and the economy is about to slip off the deep end (this has been predicted for 3 or 4 years now). I am nowhere close to that...at this point. And if we do get another bout of vicious selling, I will bet that at some nirvana point the market will decide again to take solace in the prospect of the cessation of the Fed's rate hikes...and maybe even look forward to rate cuts in 2007.

In the meantime, be careful out there!