The last 7 days or so have offered sweet relief to investors as a convergence of (some related) good news has provided wind behind the market's sails: peace in the Middle East - or at least what counts as peace in the never-ending conflicts there, a major foiled terrorism plot, a 10% drop in oil from the recent highs (and making 2-month lows), favorable inflation numbers (or at least numbers that the market chose to over-react to), reportedly good earnings from Cisco (I thought the market no longer cared?!), and, most importantly, a shift in sentiment. The sentiment has been the most important because it allows investors and traders to interpret bad news as the bottom and good news as justification.

I hate to be a sourpuss so early, but I took a quick look at the T2107 and T2108 indicators. I used these on May 15th to suggest that the bull market is tiring out. This call happened to coincide with the last tops in the major indices - neither the T2108 or T2107 were confirming the euphoria of the highs back in April and May. Thus, I am inclined to take note when I see warning signs flashing in these indicators. If you are not familiar with them, I strongly suggest you check out my previous post or do a search on these terms on TraderMike's site.

First, the T2108 has been quite impressive for two months. A higher low in July while the market (S&P 500) made a higher low on its way to a "W-bottom" confirmed that a rally was underway. Now, a strong three-day rally has finally put thie valuable indicator into lofty heights. History has shown that the market does not like to spend much time below 20 or above 80 on this indicator. We are now at 72 which means that folks with shorter time horizons need to dust off their selling plans. History shows that the market can spin around at these high levels for weeks and months, so realize that a top may not be visible just over the horizon just yet. Watch what the Nasdaq does as it approaches its 200DMA (around 2225 - about 3% away from Thursday's close). And if that is a legitimate target for the Nazz, then surely the S&P could tack on another 2% and challenge its highs for the year (5-year highs even!). This would all be happening as the market continues to obssess over inflation reports, Fed meetings, and, most importantly, tries to brace itself for the seasonal hardships in September and October. The ride to new resistance could be quite rocky with many fits and false starts.

One last note of possible interest that I did not notice in my earlier post: It seems that once a fast moving average reaches the danger zone, the need for caution becomes particularly urgent. In the chart below, I just happened to use a 25-day moving average (pink/lavender line).

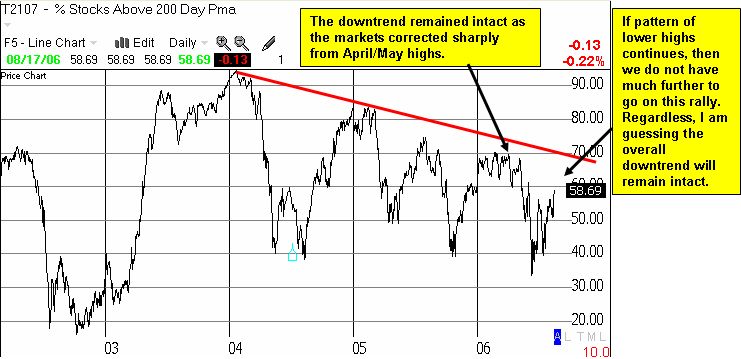

While we are checking out technicalities, let's pay another visit to the 2107. In May, I used this chart in particular to show that since the market's rocket ride in 2003, the bull market has slowly but surely lost its momentum. Low volume tests and high volume failures of the resistance levels mentioned above would mark perfect points to begin the next leg down in momentum.

Again, note that this is not a call to dump all your longs (see disclaimer here). It is a reason to get more cautious and wary! So, be careful out there!