A full seven months ago I speculated that “maximum yen bullishness” was reaching feverish levels. As a result, I concluded that a bottom had to be imminent in USD/JPY even as the momentum at that time seemed to point to that bottom happening around 7% lower at 100. I acknowledged the potential for making an early call, but I soon felt vindicated as the yen proceeded to weaken through the rest of the month of May.

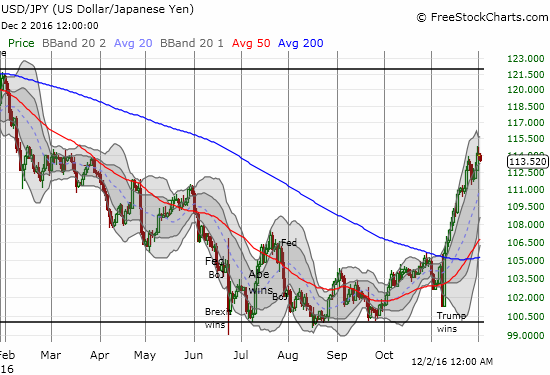

USD/JPY failed to break above the previous high in April and went on to plunge right through Brexit. That event delivered the first breach of the psychologically important 100 level since late 2013. For the next three months, bulls and bears battled it out using 100 both as a springboard and irresistible magnet. It took the U.S. Presidential election to finally deliver a decisive advantage to yen bears.

Source: FreeStockCharts.com

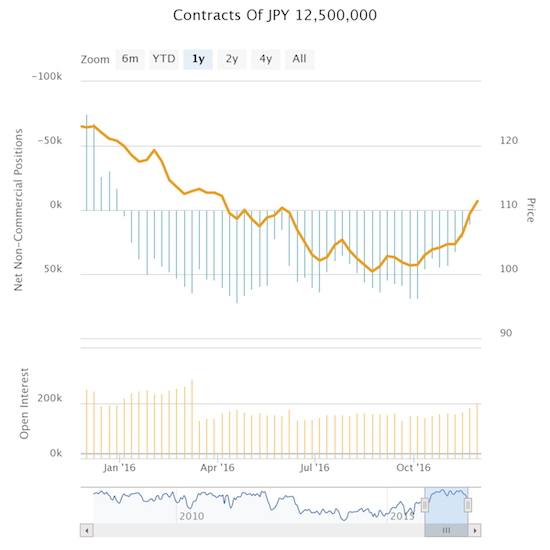

The U.S. Presidential election provided the rocket fuel for this breakout as the U.S. dollar index (DXY0) first swung from despair to elation. Currency speculators got the memo and started to complete a process that started in October of reducing net short positions. The unwind has been rapid enough to send speculators into a net SHORT positioning in the yen (by a mere 269 contracts). The last time speculators were net short the yen was at the end of December, 2015. This change ends an entire year of yen bullishness, much of which was spent at “maximum bullish” levels.

Source: Oanda’s CFTC’s Commitments of Traders

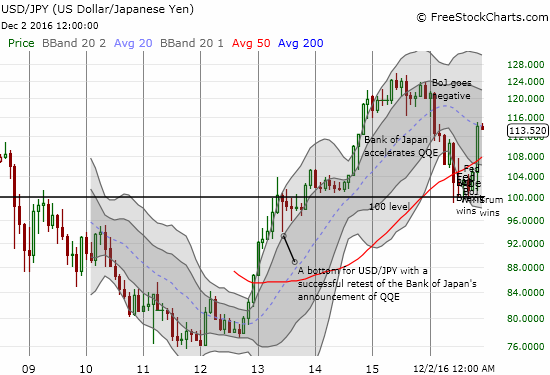

I took this opportunity to lock in profits and close out my long-standing USD/JPY position. Until USD/JPY proves it can resume its momentum with a fresh breakout, I am downgrading my positioning to very small and very short-term trades on the long side. I am particularly leery of the coming Federal Reserve meeting where 30-Day Fed Fund Futures anticipate a rate hike with a 93% probability. These high odds suggest that the market has already priced that hike into the U.S. dollar. I also suspect the sharp “Trumpflation trade” is due for a rest here. Moreover, financial markets are prone to “sell the news” type of reactions in these scenarios. If USD/JPY does sell off in the wake of the Fed meeting, I will look to buy the dip assuming interest rate differentials continue to favor the U.S. dollar, and the Fed keeps the door open to further rate hikes in 2017.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long FXY call and put options