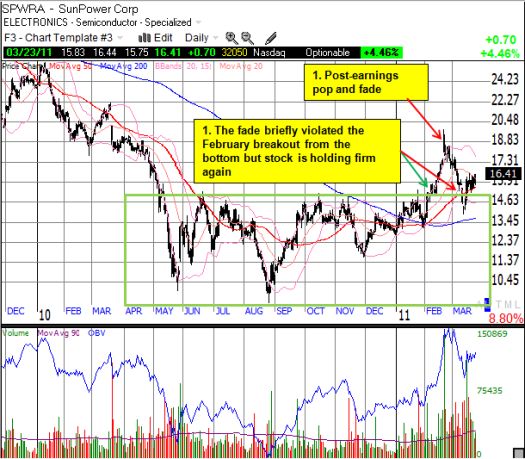

Last week, I suggested that the nuclear power crisis in Japan could usher in a watershed moment for solar energy and its constituent stocks. For all of two days, most solar stocks soared. For example, First Solar (FSLR) gained 14%. However, March 15th marked a sort of peak in the market’s concern over Japan’s nuclear power mess, and, accordingly solar stocks have drifted downward ever since. There is only one solar stock on my list that has managed to stay aloft since that day: SunPower Corpration (SPWRA). First Solar has given back half of its two-day gains. Several others have almost given back all their gains. Clearly, the watershed still has plenty of capacity.

*Chart created using TeleChart:

Coincidentally, Queen’s University in Canada released a study March 3, a week before Japan’s earthquake, titled “Diverting indirect subsidies from the nuclear industry to the photovoltaic industry: Energy and financial returns” by I. Zelenika-Zovkoa and J.M. Pearce. The study has been heavily referenced on the web (for example, here: “Solar power outshines nuclear power: Study“), but Queen’s Univeristy’s own teaser says it all: “Nuclear power not worth the risk in Canada.” The study basically quantifies the indirect subsidy that nuclear power receives from the U.S. government from a $10B cap on liability for accidents. Zelenika-Zovkoa and Pearce then conclude that this money would be better spent on subsidies for solar energy (emphasis mine):

“Nuclear power and solar photovoltaic energy conversion often compete for policy support that governs economic viability. This paper compares current subsidization of the nuclear industry with providing equivalent support to manufacturing photovoltaic modules. Current U.S. indirect nuclear insurance subsidies are reviewed and the power, energy and financial outcomes of this indirect subsidy are compared to equivalent amounts for indirect subsidies (loan guarantees) for photovoltaic manufacturing using a model that holds economic values constant for clarity. The preliminary analysis indicates that if only this one relatively ignored indirect subsidy for nuclear power was diverted to photovoltaic manufacturing, it would result in more installed power and more energy produced by mid-century.”

Elizabeth Kolbert recently gave a relatively “matter-of-fact” overview of the risks of nuclear power in the New Yorker titled “The Nuclear Risk.”

I am guessing these arguments likely hold a lot more weight north of the border. However, while Americans and the market in general yawn about these possibilities, the opportunity remains to nibble away at solar stocks. See “Another Solar Sell-Off and Another Round of Solar Buys” for my specific case for considering solar stocks buys on sell-offs. (See “Following the Charts Instead of the Bad News: Some Lessons from the Past Two Weeks” for my current perspective on the overall market).

Be careful out there!

Full disclosure: long FSLR, LDK, CSIQ, JASO, JKS, ESLR, short SHAW, long CCJ puts

Time to update the copyright to this year!

It sure is!