On Wednesday, Wunderlich Securities issued a trading call on solar stocks citing a correlation with oil prices. First Solar (FSLR) was the prime beneficiary of this research. Eric Rosenbaum from TheStreet.com beat me to the punch critiquing this call in “Should Solar Stocks Trade on Rising Oil?“, but I will add my two solar panels anyway.

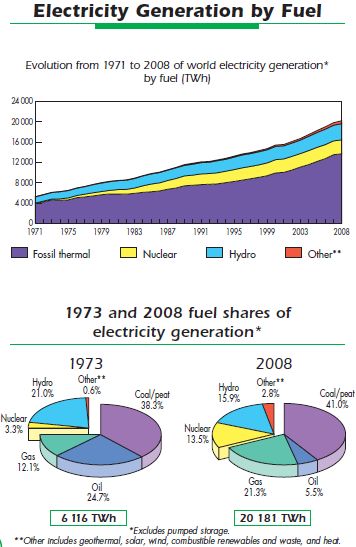

Bottom-line – do not buy solar stocks as a play on higher oil prices. In fact, just buy oil-related stocks to play higher oil prices. Solar’s main contribution to energy generation is electricity. So, solar’s main competitors are the fuels primarily responsible for electricity generation. Coal and natural gas are the twin powers in electricity generation in the United States and across the globe. According to the International Energy Agency (IEA), oil is only 5.5% of all electricity generation. Coal and natural gas combined are 62%.

Source: International Energy Agency: 2010 Key World Energy Statistics (original file can be found here)

The U.S. Energy Information Administration’s Annual Energy Review 2009 shows oil is a mere 1% of the mix in the United States.

Wunderlich is focused on the recent strong correlation of First Solar to WTI (West Texas Intermediate) oil. However, the real story may be that oil has had an unusually strong, positive correlation to the stock market. Given solar stocks have benefited from a stronger stock market, the correlation between oil and solar is more of a fortunate coincidence. From Rosenbaum’s article:

“Pavel Molchanov, analyst at Raymond James, who covers both traditional and alternative energy stocks, said that, historically, oil has traded in an inverse relationship to the equities market. In the past few years, that has not been the case, as rising oil prices have coincided with rising equities prices. This correlation explains the rise of the price of a solar stock like First Solar amid a general equities market and oil price upswing.”

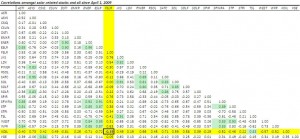

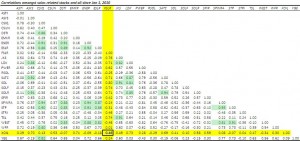

So, over the past year or so, FSLR and oil have tended to go in the same direction when looking at current prices. (Do not forget that FSLR is also part of the S&P 500 index). However, the day-to-day moves show that this relationship is hardly tradable. In other words, if you have a bullish outlook on oil, stick to bets on oil. The actual correlations using a daily time series show that First Solar has had a slightly negative correlation to oil (using XOIL, the Amex oil index) since April 1, 2009, right after the March, 2009 lows, and only a 0.48 correlation since the beginning of 2010. These underwhelming correlations mean that there will be significant periods of time where the First Solar vs oil trade has performed very poorly, and you could easily get stopped out of the trade. I expect these weak relationships to continue.

I created a correlation matrix across my list of solar stocks and oil. For any two stocks with a correlation of 0.80 or higher, I highlighted the related cell in green. Click on the images for a larger view.

Note that since the stock market bottomed in March, 2009, only Trina Solar (TSL) has had a strong correlation to oil (0.80 or higher). This occurred given TSL’s extremely strong year in 2009 while oil was also recovering at a fast pace. Many solar stocks languished throughout 2009. Limiting the time window to correlations since 2010 drops even TSL from the list of strongly correlated.

Note also that given the size of the matrix of stocks in related industries, we should expect to find at least two stocks, and likely a few more, strongly correlated to another just at random, so I am not making any general conclusions for trading. It could be interesting to speculate on some of these relationships, but I will restrain myself for now.

Regardless, First Solar (FSLR) has done well with all the analyst attention it has received lately. It is now trading just above my $160 upper limit for the presumed trading range. Shorts are as bearish as ever with 31% of FSLR’s float traded short as of Jan 14, 2011. The total shares short have remained around 16M since the end of November. I highly suspect the next round of data will show shorts closing out positions in the wake of this rally. If not, particularly if shorts have decided to double down, I suspect FSLR will retain extra fuel to power higher on this momentum.

Be careful out there!

Full disclosure: long TSL, SPWRA, WFR, JKS, ESLR, USO (with a covered call), and SSO calls

Hey… Nice blog, Ilove your the content. And I want to learn a lot from your blog.