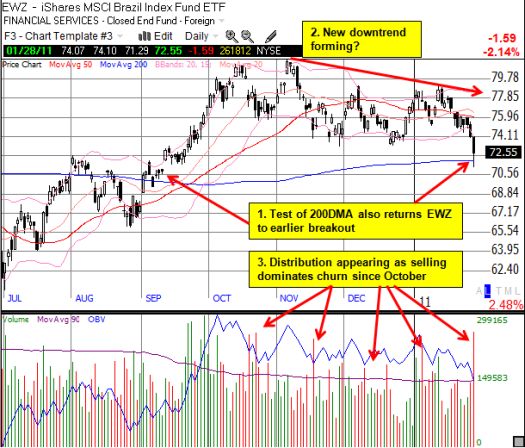

The iShares MSCI Brazil Index Fund ETF (EWZ) broke out in early September, 2010 from an important downtrend pattern. At the time, I lamented that I missed the move because I was still playing the strategy of waiting for a 20% correction in EWZ before making a purchase. On Friday, EWZ completed a roundtrip from that breakout point and retested its 200-day moving average (DMA). While such a technical event normally motivates me to start buying, I see a new potential downtrend forming in EWZ that looks all the more ominous given Brazil’s increasing struggles with capital controls and growing inflation concerns.

I pulled back to a weekly view to get a better perspective on where EWZ sits relative to the former downtrend. I was quite surprised to realize that EWZ essentially went nowhere in 2010, thus under-performing the S&P 500’s 13% gain on the year. This view provides a stark contrast to all the analyst and pundit talk about favoring emerging markets over the U.S. stock market.

*All charts created using TeleChart:

All things considered, I will remain content to watch EWZ from the sidelines. If it prints another 20% correction from recent highs, I will definitely be a buyer. Anytime before that will highly depend on unfolding financial and political events in Brazil.

Be careful out there!

Full disclosure: no positions