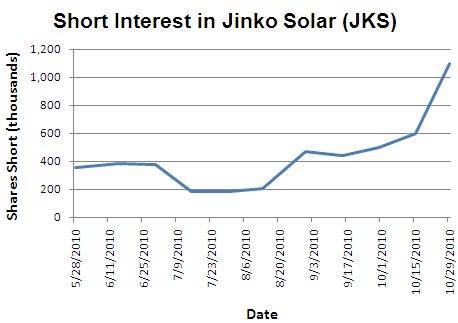

At the time I provided my summary of the stellar earnings results from Jinko Solar (JKS), I noted that the post-earnings surge in the stock price of 17% was likely partly the result of short-covering. Only data through October 15 was available then, and it showed all-time highs in short interest. The data for October 29 shows that shorts accelerated their activity ahead of earnings. Short interest in JKS increased 83% to 1.1M shares. This is 5% of the total float and comparable to an average day of trading volume for JKS. The next update on JKS short positions should come sometime this week (updates are provided every two weeks). I will be looking to see whether shorts responded to earnings by reducing positions or instead doubled down, which can happen when shorts chase stocks in stubborn uptrends.

JKS peaked three days and another 19% after announcing earnings when the copmany released news of the pricing of a follow-on offering 3.5M ADSs (American Depository Shares) at $36 each. As of Friday, JKS has reversed about 50% of the post-earning reaction and is about 10% below the pricing of the follow-on offering. The IPO lock up expired November 9 and is likely providing additional pressure on the shares.

With these headwinds out of the way, I finally decided to initiate a position. The breakout above consolidation still holds and now stochastics are getting oversold for the stock (see chart below). I only took on a partial position given the overall risk in the market of a larger extension of Friday’s sell-off. If JKS continues dropping, I will look to add more if the selling slows down as it returns to previous consolidation area (between $26-29).

I have posted below updates on the short interest in JKS and its price chart (note that in my last post on JKS, I neglected to note that the y-axis was scaled to thousands of shares).

Source: Nasdaq.com

*Chart created using TeleChart:

(Earnings related side-note: I am still trying to catch up to last week’s deluge of solar earnings from six companies. The headline news was almost all bullish and consistent with reports to-date, so I am eager to dive in. Stay tuned.)

Be careful out there!

Full disclosure: Long JKS