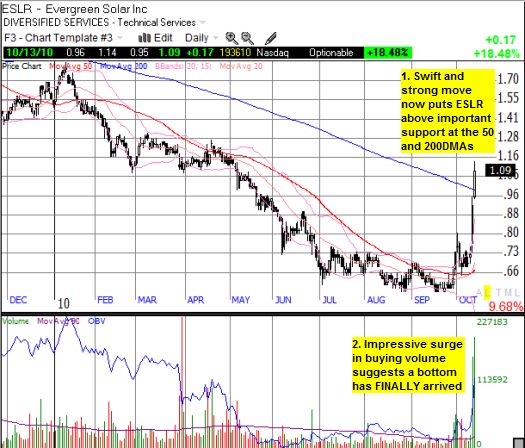

Evergreen Solar (ESLR) is picking up where it left off. ESLR ended September with a 20%, 2-day gain, and for October, the stock is already up another 50%. In just two weeks, ESLR has rolled back over four months of losses.

*Chart created using TeleChart:

ESLR is currently showing off its “Made in the U.S.A.” solar panels at Solar Power International, so I can only guess that something management did or said at this expo generated a buzz. The related press release has a notable focus on creating American jobs. This is a smart departure from earlier conference calls where management sold analysts on the expected cost savings of establishing manufacturing facilities in China.

“Evergreen Solar continues to produce String Ribbon solar panels and deliver more electricity with the lowest environmental impact at our U.S. manufacturing facility in Devens,” said Scott Gish, Evergreen Solar’s Vice President, Sales and Marketing. “As an American company and one of the largest solar employers in the United States, we recognize the importance of the American Recovery and Reinvestment Act in helping the U.S. economy and growing the number of jobs in this country. As the number of ARRA solar projects continue to increase across the U.S., our ES-A series panels will continue to be the panel of choice for American-based installers and end users.”

Republican Senators singled out ESLR for scorn during a Senate committee hearing earlier this year for the large amount of American subsidies the company has taken while at the same time generating its new jobs in China. ESLR management defended its record in a subsequent earnings conference call, and it appears their campaign continues.

I essentially wrote off ESLR in July, so I will be eagerly looking for any relevant news that signals the company will once again escape almost insurmountable odds…

Be careful out there!

Full disclosure: no positions