The U.S. dollar index touched its 200-day moving average with the kind of precision only a technician can love.

*Chart created using TeleChart:

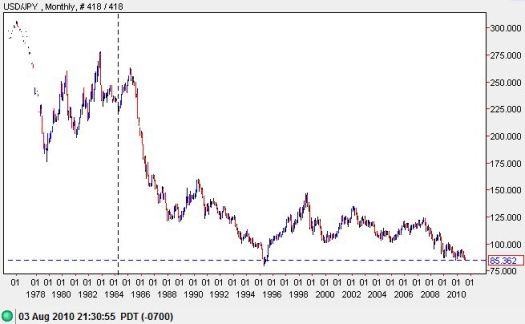

I keep waiting for (and betting on) the dollar to get a nice relief bounce against the yen, but the dollar’s near straight-line descent has been the main story. While I wait for “judgment” time on the U.S. dollar, I decided to pull up a long-term chart of the dollar versus the Japanese yen. I was quite surprised to see that the U.S. dollar has declined against the yen over a 25-year span. The dollar is sitting on 15-year lows again, and 30+ year lows are right around the corner. Maybe the Japanese economy has struggled to lift far out of deflationary funk partially because of this currency dynamic between two important trading partners. While the Japanese have struggled mightily to debase their currency for years and years, the U.S. has actually succeeded in this race to the bottom.

Source: dailyfx.com charts

It appears there is plenty of tension winding up in forex just looking for an excuse to explode (like the jobs number this Friday!). I think folks trying to trade stocks through these next few days will do well to keep one eye on currencies.

Be careful out there!

Full disclosure: long USD/JPY