The stock market is now on day #6 of this oversold period and a powerful resolution to the upside is beginning to look less likely. Asia and Europe led off with powerful rallies. However, the U.S. follow-through stalled out and fell short. Although the indices faded hard and ended notably down, the percentage of stocks trading above their 40-day moving averages (T2108) slightly increased from 11 to 12%. The VIX was down as much as 16% before rebounding sharply to end the day 1% higher.

All this adds up to some very choppy trading action. Today, I was forced to start adjusting to the potential for an extended oversold period. I sold several aggressive positions into the rally and added to my June puts. It is not my ideal positioning, but I am now considering more downside scenarios.

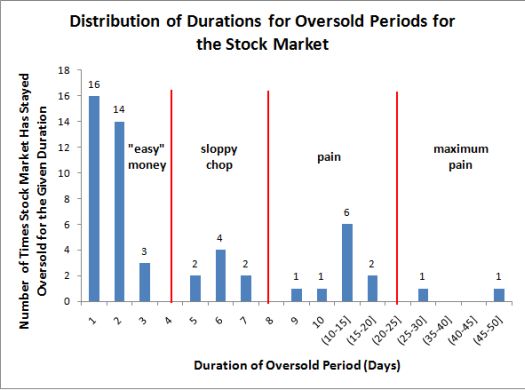

The chart below provides the source of my concern. I constructed a distribution (histogram) of the durations of each oversold period in the stock market as defined by T2108 dipping to and/or below 20%. Of the 53 oversold periods, 33 (62%) last no more than 3 days. The oversold period in early May lasted only two days and provided good profits on the subsequent bounce out of oversold territory. With the current oversold period dragging on to six days, the stock market is in the middle of a period I call “sloppy chop.” It is a period where the stock market soars and sinks day after day, raising hopes of bulls and bears and disappointing both. If oversold conditions last one more day, suddenly, the prospects of remaining oversold for a while loom large. Entering such a zone likely means a lot more downside, not just more chop.

Source: Worden Telechart

The crash of 1987 delivered the longest oversold period. It lasted 41 days. The “panic of 2008” would have matched this pain but after 26 days of staying oversold (and sinking fast), T2108 marginally jumped back above 20% for one day before falling back below the threshold for another 15 days.

Given the sloppy chop, I am also suspending updates to my list of candidate stocks for playing this oversold period. Instead, I will provide one final update once the stock market exits this oversold period (and it will eventually!). Up to this point, the strongest stocks, those that closed above their respective 50DMAs on the first bounce of this oversold period, have provided the best risk/reward (to-date, only six of these stocks have now fallen below their 50DMAs). As this oversold period drags on, I suspect that the strongest stocks will finally buckle. When the oversold period ends, I will be particularly interested in finding out whether the stocks that began as the weakest end up providing the strongest gains in the ensuing rally.

Be careful out there!

Full disclosure: no positions