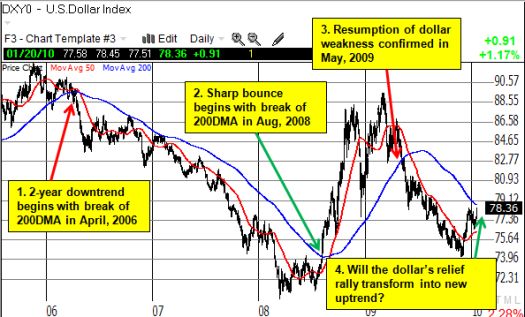

I did not think I would consider (this soon) whether the dollar’s short-term downtrend is ending. I thought this month’s unemployment report put an end to the dollar’s relief rally, but the dollar has surged in the past 3 days to recover all its losses since the most recent peak in mid-December. Even the Australian and Canadian dollars have given up ground after re-challenging levels last seen in mid-2008. Now, the 200-day moving average (DMA) looms directly overhead for the dollar index (DXY0). The chart below demonstrates why I am paying close attention to this technical price average.

*Chart created using TeleChart:

There are also some fundamental reasons that could support a sustained rise in the dollar here. Recent news from major central banks indicate that the eurozone, British, and the Canadians are not eager to raise interest rates (surprise, surprise). Sovereign default issues in Europe suddenly matter again. Of course, the Japanese will not be raising rates anytime soon as deflationary threats continue to linger in the Japanese economy. China’s apparent move to tighten monetary policy reminds the market of the removal of emergency stimulus in the U.S. Add in stock markets that are finally looking a bit tired, and conditions build for skittish investors and traders to reach for the “safety” of U.S. dollars (like running from a forest fire into a burning building).

The long-term, multi-year downtrend on the dollar is well intact (chart not shown), so I remain bearish. However, I must respect these shorter-term technical and fundamental developments and prepare to switch to a “long dollar” mentality if the 200DMA decisively breaks to the upside.

Be careful out there!

Full disclosure: long USD/JPY, AUD/USD, FXA

2 thoughts on “The Dollar’s Short-Term Downtrend May Be Ending”