First Solar Prepares for the Challenges of Changing Solar Markets

By Dr. Duru written for One-Twenty

July 01, 2009

First Solar (FSLR) hosted an all-day analyst meeting last week in Las Vegas, NV. I could not find a complete summary of the event, so I decided to listen to it myself. FSLR's executives provided a thorough and comprehensive presentation of the company and their perspectives on the solar industry (click here to listen to the webcast and download the presentation). FSLR is preparing to face the challenges of major changes in the markets for solar technology. The executives focused on the long-term view, explaining that they are building a company for the next 50-100 years that is part of a carbon-free infrastructure helping to fight global climate change. FSLR's immediate challenge is to expand from saturated subsidy markets to "transition markets." These markets are less dependent on subsidies but involve major investments in large-scale solar power plants and the necessary grid infrastructure to support solar-generated power. Sustainable markets develop after transition markets, a time when solar is a well-established component of worldwide energy grids.

After listening to the webcast, I understand why FSLR made the special effort to present so much revealing detail (including a tour of one of its facilities): in its own words, "the complexity of the business means higher risk of lumpiness in results in the future." In other words, the investment community must moderate its expectations. To bolster the re-orientation, FSLR's CFO also redirected analysts to measure the company on EVA (economic value-added) and RONA (return on net assets) and not gross margins. FSLR projects gross margins to erode slowly over time. The risks to FSLR's business (and all of solar) will continue increasing as the industry struggles to establish the transition markets. We should expect this in any market that requires major increases in capital investment and integrated and coordinated infrastructures crossing many political boundaries. FSLR acknowledged that it needs a convergence of economic and political forces to build upon its current success. FSLR has a first-class handle on its technology and manufacturing processes, and the company should remain unrivaled for quite some time. However, there are many external forces that are largely out of its control but critical to extending further this technical prowess into market prowess.

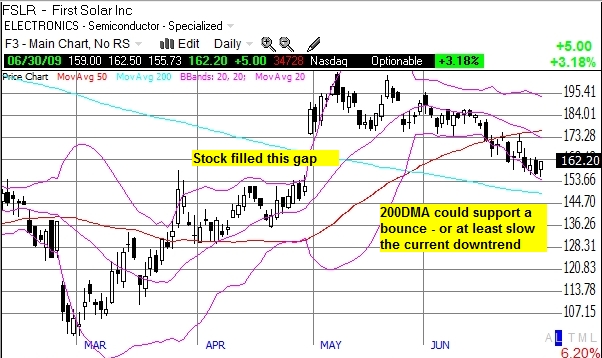

FSLR's premium valuation relies on its technology but often does not take into account general industry risks. When I flagged FSLR as a short in May due to massive insider selling, I set an initial target of filling its post-earnings gap (up 23%) from April 30th. That gap has been filled. At a trailing P/E of 29 and forward P/E of 19 (as of June 30th), valuations are now more "reasonable", but I think around a 15 P/E would be closer to "fair value" given existing risks. This translates into an approximate (near-term) price target of $130. I am much less confident about the next (potential) 30 points down than the previous 30 points down given multiple points of technical support that could provide fuel for robust relief rallies. The bottom of the post-earnings gap should provide some support, and the 200DMA will likely provide longer-lasting support (see chart below). The next big downward catalyst will probably be the next earnings call when FSLR's message really sinks in.

Below are my notes from the presentation. If you are interested in FSLR and the solar industry, I highly recommend that you listen to it for yourself or at least skim through the detailed presentation and review the summary slide at the end. These notes are not a complete summary, just a list of highlights that most caught my attention. As expected, FSLR definitively addressed the question of competition with crystalline silicon (c-Si), proclaiming that FSLR will remain very cost competitive under even the most dire scenario. However, FSLR only gave cursory mention to the potential for financing customers. Finally, I was also intrigued to hear that FSLR considers an equity offering to be one of several possibilities for raising capital to meet imminent capital challenges.

===============

Notes from First Solar's Analyst/Investor Meeting, Westin Las Vegas, June 24, 2009

"Strategic Direction": Michael Ahearn, Chief Executive officer, Chairman

- FSLR is building a 50, 100-year company...one not subsidy-dependent, part of low carbon infrastructure

- Letting out more info today than in the past

- Kyoto treaty is driving activity in renewable energy - growing acceptance that climate change is real. Tailwinds from these externalities like never before

- Existing subsidy markets are saturating - hard to imagine there are any new countries with substantial subsidies coming online

- Starting to move to "transition markets"

- In transition markets, solar runs into problems integrating into the existing grid

- Becomes transformative and requires seeing solar as a long-term energy partner

- Not just about parity price, more about integration

- At 10cents/kWH can clear almost any electricity market on the planet in a low carbon infrastructure

- Solar is disruptive to the existing infrastructure - there will be issues to overcome to make it mass accepted

- Value solar economics relative to conventional energy: cap and trade, carbon tax. Monetize externalities, otherwise will always have to have subsidy injections

- Determine distribution - large scale vs distributed model. In order for solar to be relevant to climate, must be large-scale installations. Then how do you develop the transmission - have to convert lines to higher voltage. Regulators and utilities typically do not do this (tax rate payers). Have to coordinate across state lines. Broader role for FERC (Federal Energy Regulatory Commission) in US is helping

- Financing - must be a way to access project capital at higher volumes and lower rates. Policy will have to drive project finance markets

- Fluctuating voltage from solar is more of a problem with higher scale of transmission. Lacking the data right now to characterize the problem well

- First Solar cannot get to where it needs to go without an entire industry. Policy-makers are not going to design the grid around one company

- Technology trumps low labor costs

- Transition markets are an imperative

- Hard to say which markets will move along from subsidy to transition and then sustainable

- Trend toward vertical integration in the industry

- First Solar still delivers more value and lower overall cost than the entire spectrum of crystalline Silicon (c-Si) companies (see slide #31 of presentation)

- Energy Payback Time (EPT) is less than 1 year (EPT is the amount of time the solar system must run to produce the same amount of electricity required to fabricate the system)

- Target 52-63 cents/W cost in 2014. A lot of this from improving efficiency

- 80 MW/Line/Year for factory run rate by 2014 as well

- Trajectory is in-line with existing 2012 commitments

- Safety is the #1 value

- Five-year development time for solar plants

- Maintain existing patents that cover the core FSLR value-proposition

- On-going improvements are well-protected: they form the basis for sustained differentiation

- Much of FSLR’s differentiation is unpublished

- No margin targets. Throughput targets, P&L, balance sheet efficiency

- There is a finite pool of subsidies

- EVA (Economic Value Added), not gross margin, is strongly correlated to stock market returns for solar companies (slides #101-102)

- Selling a capital good with 30-35 years, not an electronic device or component that has product lifecycle of 6 months that relies on discretionary spending. So, must find access to capital at a low cost

- Capital requirements (slide #104): 1 GW of Production ~$800M capex; 1 GW of Generation assets over $3.0B/year

- Working capital - Cash realization cycles

- 50 days module sale

- 6-9 months turnkey project sale

- Development business sale up to 3 years

- Limited FSLR equity is an option for raising project term financing (slide #105)

- All sources of capital are inadequate for massive capital needs. FSLR needs to be a financial powerhouse, maintain strong balance sheet

- Sustainable competitive cost advantage over c-Si through at least 2012

- The solar industry is not about fighting with c-Si; current tension is about fighting over limited subsidies

- Risk is not in construction, it is in weighted-average cost of capital

- Consolidated gross margins will decline as the markets transition (50-55% to 45-50% in existing subsidy markets; 35-40% in transition markets; no estimate for sustainable markets)

- Will maintain 20% model RONA (return on net assets)

- Business model is getting more complex. Can't use simple equation to calculate gross margin with ASPs, manufacturing run rate, etc...

- We are not chest beaters, not cheerleaders. World is not always rosy.

- Solar market is much more uncertain now. Days of just signing and booking big contracts and running are gone

- System prices may need to come down to stay competitive and drive scale

- Need to take big steps to convince policy makers and politicians to spend big money

- Will become local player in markets that are going to matter

- Financial stress on the channels is still an issue, mainly project or system finance constraints. Not a lack of access, but timing

- Impossible to forecast all the capital requirements in advance

- Pricing strategy

- Ideal situation for lowering price is when there is demand elasticity that can lead to market creation. Provides clear upside

- Non-ideal situation for lowering price is in subsidized market where you are just trying to push product to meet existing plan in an over-supplied market. This is a distinct possibility given drop in poly-silicon prices which have dropped steadily since Q4

- Question is whether price is the constraint or is it other factors like project finance or approval

- Lower pricing is not something to rush into without more data, especially since the situation is a bit fuzzy right now

- Easy to get caught up in market hype

- This is about being a good partner with customers

- One option is to provide project finance (provided example of one project)

- No decision to announce yet, things are moving so fast, hard to see the real data points

- Longer-term, say 2010 and beyond, there will be major discussions in EU markets about next round of solar projects

- FSLR would prefer to see larger projects with lower feed-in tariffs

- Have not thought about vertically integrating with the solar utility model in the Europe market

- Complexity of business means higher risk of lumpiness in results in the future

- OptiSolar acquisition is not about competing against existing customers

- Looking to prime market with larger capital projects to gain more visibility on the business

- Models of cost competition assume full vertical integration in the lowest-cost manufacturing environment that they can envision. Also includes inflationary impacts on their own cost model

- Would like to form a pact with PV companies to establish firmly the industry

- There will come a point in time when technology is essential to keep driving down cost points

- FSLR is a legitimate competitor to solar thermal and perhaps complimentary. Expect solar thermal projects will be harder to finance. Need to get some of those projects going to see what happens

- Still need to collect more data on characterizing the voltage variability problem. Maybe in 3 years we will know better whether storage is needed

- No interest in vertically integrating into glass since it does not represent a constraint on the business