Down Gaps Are An Increasing Share of Stock Market Losses

By Dr. Duru written for One-Twenty

May 28, 2009

Earlier this month, I examined whether up gaps in the stock market are contributing to an "unusual" amount of the stock market's recent gains. I concluded that "today's rally does include a 'disturbing' percentage of gains from up gaps, particularly when compared to the bear rallies since 2008." However, that analysis did not examine the impact down gaps have had on losses in the stock market during extended periods of selling. It turns out that down gaps are also having an increasing impact on overall stock market action. Overall, the most interesting feature of the contribution of gaps to stock market performance is that the relative impact of up and down gaps diverged sharply as the last bull market came to an end.

For convenience, I repeat the definitions and assumptions for this analysis:

I define a down gap as any close below the previous trading day's close. (Note that TradingMarkets.com offers a more refined definition: a down gap is a close below the previous trading day's low and a "lap down" is a close below the previous trading day's close). To measure gaps in the stock market I use SPY, the SPDRs S&P 500 ETF. SPY provides a more accurate view of the stock market open than the S&P 500. For comparative purposes, I only analyze the down gaps from periods where the S&P 500 (SPY) is correcting the previous rally (selling off). The date range for sell-offs is defined by default as those days between SPY rallies as defined in the previous analysis (note that I have marked the dates without regard to weekends or holidays - trading activity is of course only analyzed on days the market was open). I segregate the analysis according to periods of rallies and sell-offs since up gaps get nullified (in the aggregate) during sell-offs and vice versa - perhaps in a future analysis I will examine gaps across all periods, but it appears the current analyses are sufficient for the purpose at hand.

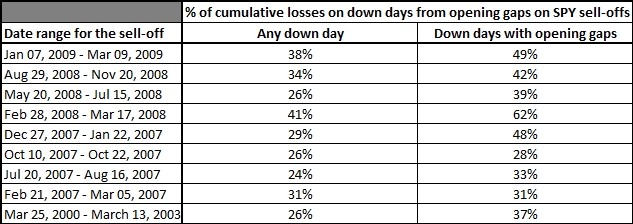

For each sell-off, I sum up the cumulative total of losses from ALL days that ended with a loss. This means I exclude from the analysis all days that end in a gain from the previous trading day. I use this cumulative method in order to capture the impact of any and all down gaps. I distinguish between down days which begin with a gap down and days that do not. Thus, the table below quantifies two measures: 1) the second column, labeled "Any down day," quantifies the percentage of cumulative gains delivered by down gaps - if the open is positive, I zero out the gap's contribution to the day's loss; 2) the third column, labeled "Down days with opening gaps," quantifies the percentage of cumulative losses delivered by down gaps ONLY on trading days that start with a down gap. In both cases, the down gap is capped at the total loss on the day. I only include the third column for reference.

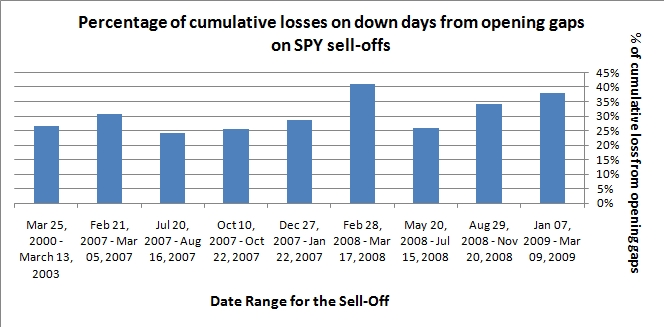

The chart below shows this same data in graphical form.

So, as it turns out, down gaps have been increasing contributors to the losses on any given trading day just as up gaps are increasingly contributing to the gains in the stock market. In other words, an increasing portion of all the stock market action is happening before the market even opens. (One could reasonably argue that the current trend for down gaps began July, 2007 with the sell-off leading up to the demise of Bear Stearns representing an outlier in the series. There may also be a relationship between the intensity of the sell-off (rally) and the percentage of the action that occurs before the market opens).

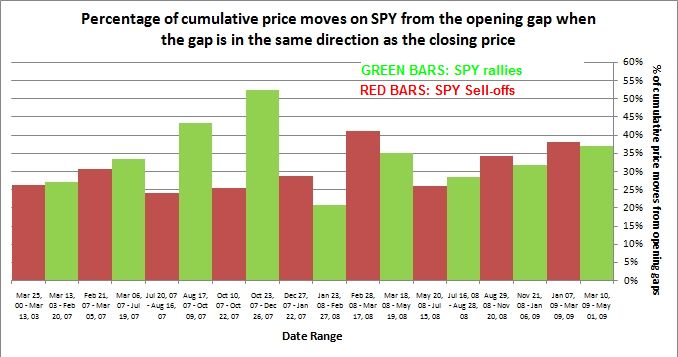

To make the point clearer, I have added another chart below that combines the analysis from both up and down gaps. The green bars represent rallies in the SPY (as defined in the previous article), and the red bars represent sell-offs in the SPY (defined by default as the periods between rallies). The bars are lined up side-by-side to clarify the differences and similarities.

Not only does this comparison demonstrate that up gaps have not been particularly unique from down gaps during much of this bear rally, but also this comparison reveals just how far the contribution of up gaps diverged from down gaps as the last bull market came to an end. The contribution from up gaps surged while the contribution from down gaps tailed off. Thus, I remain more intrigued about the implications of opening gaps for bull markets than for bear markets. Overall, it is more likely that divergences in the contributions from directional gaps are potential signals of looming, important changes in market character than the trend in one type of contribution alone.

(Click here for suggestions on how to trade opening gaps by Dave Landry. Trader Mike does a review of "Mastering the Trade" by John Carter which includes additional tips on fading gaps.)

Be careful out there!

Full disclosure: long SDS. For other disclaimers click here.