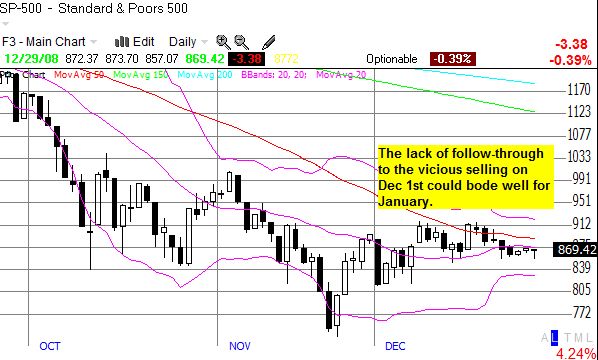

On December 1st, 2008, the S&P 500 dropped -8.9%. At the time, it seemed a resumption of months of selling was underway. But 4 weeks later, the stock market has yet to break the lows of that day. The S&P 500 made new highs for the month and now trades right in the middle of that seemingly ominous day. We now have an almost eerie December calm. Since the most recent sell-off began in September, every big selling day that followed even one day of buying, gave way to new lows...except December 1st. We got no follow-through even though that day was one of the three worst days of the severe correction: on September 29th we had a -8.8% drop and on October 15th we had a -9.0% drop. It is as if the sellers all convened at the same time to wash themselves of the market one final time for the year.

Is there any significance then to December 1st? There could be. If you were selling for tax reasons and wanted to have cash ready to start buying back your shares as soon as trading begins in 2009, then December 1st was almost your last day to sell to avoid the wash sale rule. Given the ferocity of selling over the past 3 months, a day of (forced) calendar-based selling should be equally ferocious. In addition, the preceding Thanksgiving holiday week had produced a strong rally off the 52-week lows on declining volume and provided too much temptation for sellers. If taxes explain a good portion of the selling on December 1st, then we should see equally vigorous buying within the first week of January, perhaps even the first trading day of the year (January 2nd). Note that we have earnings and the Presidential inauguration that will loom large next month. Anyone who believes in the second-half recovery story (recoveries seem to always be second-half stories) will want to get in ahead of January earnings. I suspect that no matter how bad the news gets during earnings season, there will be plenty of bulls who will suggest that the news cannot get any worse and/or that the news has already been priced into the market. This claim will be the only way to cling to a second-half recovery story. Anyone who believes in the Obama-rally narrative will want to get in before January 20th. These two events should be the major positive catalysts for January (unless of course the Fed decides to pull out some more magic tricks). So, if we see no strong buying attempts ahead of either event, I would next expect the December low to break in short-order and new 52-week lows to follow soon after that as the paths of least resistance.

These scenarios are necessarily speculation on my part. I am mainly thinking out loud, pondering the potential paths the market may take in the short-term. I did not exam seasonal stock data because I think the context here is too unique for fair historical comparisons.

I also continue to watch the VIX. Last week, the VIX finally broke the November low and confirmed a double-top. I expected such a break to drive the VIX back to 30 in short order. Instead, it has drifted and lingered. I will get very wary if the VIX does not soon resume its new downward trend in early January.

Be careful out there!

Full disclosure: long S&P 500 in an index mutual fund. For other disclaimers click here.

Sponsor messages:

MarketClub is a tool that thousands of self-directed traders use. Click here to get 2 free months to see what helps them succeed.

INO will be adding dozens of the top experts and might be raising the price, so get a yearly membership and take advantage of the new authors to be added in 2009!

Share