Is Apple A Market Barometer? - Examining Jim Cramer's Claim

By Dr. Duru written for One-Twenty

November 8, 2008

Share Click here to suggest a topic using Skribit. Search past articles here.

Last week, on October 28, Jim Cramer called Apple (AAPL) a barometer of the market: "...if Apple's stock price is falling, the markets are clearly headed lower...When Apple goes higher, the rest of the market comes with it." Cramer even goes so far to say that if he "had Apple on his [trading] screen, he would trade better than most people." See video below or click here:

As with most bold claims like this, no data or evidence was presented to substantiate the relationship. If you know me at all, you know I finally had to take a look at the data for myself.

Since Cramer seemed to imply that the tight correlation between the market and Apple (AAPL) is relatively new, I focused on the stock market action since October 1st - a total of 28 trading days through November 7th. This covers a period of intense selling when it seemed like equities were being tossed overboard in unison and uncaring abandon. I defined "the market" as the S&P 500. Our first comparison is between daily percentage changes in price.

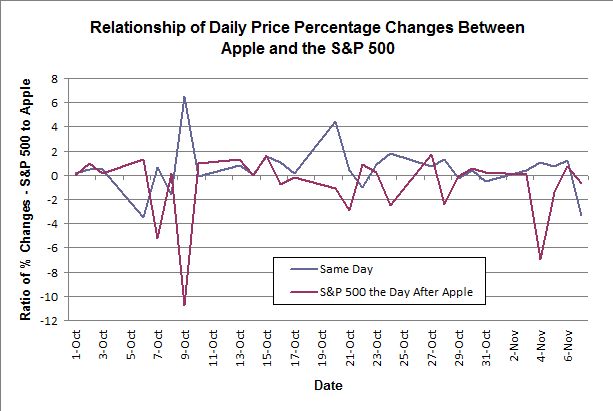

The chart below shows a ratio of the daily percentage changes in price of the S&P 500 and AAPL (change in the S&P 500 divided by the change in AAPL). The chart also includes a ratio calculated using the S&P 500's change the day after AAPL's change. 75% of the time, AAPL and the S&P 500 move in the same direction. However, 50% of the time, the S&P 500's price moves opposite AAPL's price the previous day. So, AAPL's close tells us nothing about the market's close the next day. This diminishes AAPL's usefulness as a tell for market direction.

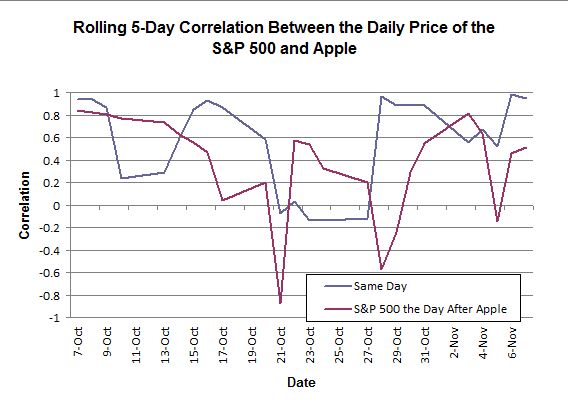

Next, let's look at correlations between closing prices. Over the past 28 trading days, the closing prices of the S&P 500 and AAPL have a correlation of 0.32. There is positive correlation, but it is weak (correlation ranges from -1 to 1 where -1 means perfectly inversely correlated, 0 means perfectly uncorrelated, and 1 means perfectly correlated). We get a slightly better correlation of 0.46 between AAPL's closing price and the S&P 500's closing price the following day. The correlations are relatively weak because the magnitude of price changes have little consistency (as shown in the graph above).

Finally, let's look at a 5-day moving correlation in case there is a trend that Cramer has picked up towards an increasing tendency for correlation. Unfortunately, the story is quite mixed here as well. There is an increasing trend only if you remove the first half of October. AAPL and the S&P 500 have gone through short bursts of time of extremely high correlation, sometimes essentially 1. So, perhaps we can excuse Cramer for his claim if he has been doing some selective observation. Note that the rolling 5-day correlation is much weaker when we look at the closing price of the S&P 500 the day after AAPL's closing price.

The most notable disconnect between AAPL and the market came the day after AAPL reported earnings. AAPL ended that day (October 22nd) 5.9% higher despite very disappointing guidance. The S&P 500 cratered -6.1%. The next day, the index managed to gain 1.3% but only after first falling another -4.3% in price.

So, when we look at the data, Cramer's claim turns out to be weak except when we look at day-to-day directional moves and exclude the magnitude of price moves. Under these conditions, I would not rely on AAPL as a barometer of the market, but it is understandable that Cramer could make this mistake if he were examining very specific time frames.

As a sidenote, Stephanie Link, who is Director of Research for Jim Cramer's Action Alert portfolio, recommended avoiding Apple on October 26th.

Be careful out there!

Full disclosure: Long S&P 500 in an index mutual fund. For other disclaimers click here.

Share