Commodity-Related Companies Fight Back with Buybacks

By Dr. Duru written for One-Twenty

September 15, 2008

Share Click here to suggest a topic using Skribit. Search past articles here.

(Quick side note before I begin...As I wrote this, I watched CNBC's special report on the latest convulsions in America's financial system. Lehman going bankrupt. Bank of America buying Merrill Lynch. AIG in desperate need of $50B before the market opens on Monday. As I finish this, futures are down 3-4% across all the major American indices. Yikes! And then a Fed meeting on Tuesday where the market may force the Fed's hand to try another desperate rate cut. All this stuff could completely invalidate any attempts to interpret the [short-term] technical information in the charts shown below).

Last week was a big week for commodity-related stocks. It began with another two days of heavy selling and ended with a big bounce on Friday as the dollar took a sudden dive. In the middle of this action, we had at least three important companies announce large share buyback and repurchase programs to fight back against the selling: Joy Global (JOYG), Potash (POT), and Foster Wheeler (FWLT).

As I have watched the on-going slide in commodity-related stocks, I have felt compelled to nibble and nibble. I could never commit much because the ugly chart technicals have betrayed any conclusion I can reach about fundamental value in this space. These recently announced buybacks give me a little more confidence in the values I believe should be here. Also supporting my increased confidence is the growing opinion that the battle against inflation has been won and the all-clear is appearing for central banks worldwide to start debasing their currencies in order to stoke economic growth. If so, it sounds like a time for owning physical assets again. Finally, it seems like we are reaching capitulation type selling as a viciously negative feedback loop has developed between nervousness over the global growth story and forced liquidations by hedge funds and other large financial institutions. A key wildcard remains the dollar. It has rallied strong and hard the past 6 weeks. I continue to doubt this move, but I also recognize that the trend can carry on further and longer than what any skeptic might think makes sense. America's financial situation only gets worse, not better, and folks looking for a refuge in the dollar seem to be looking for the weakest bomb in a minefield.

So, the search for clues into what to do continues. Although company buybacks are never a guaranteed indicator of a company's strength, these buybacks make sense to me given what these companies have said as recently as their last earnings reports. Let's take a quick look at the charts of each of these stocks. (All data comes from Yahoo!finance as of September 12, 2008).

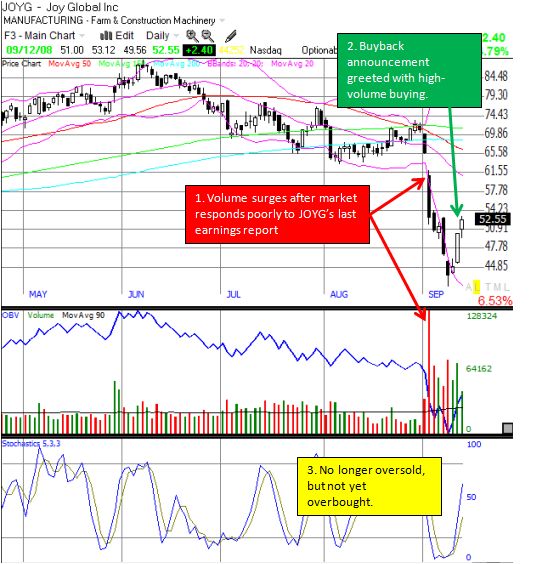

I was already long JOYG, and I added to my position after the announcement of its buyback on the evening of September 10. (< a href="080908_SP500At1200Again.htm">I talked about JOYG last week as well). JOYG doubled its buyback from $1B to $2B. This is incredible for a company whose market cap is under $6B. With cash holdings of $307M and debt of $565M, we have to assume that this buyback is going to occur over a very long period of time. Still, JOYG's chart shows that a credible bottom could be in place. Note well that overhead resistance is heavy with the 50 and 200DMA converging near the post-earnings gap down.

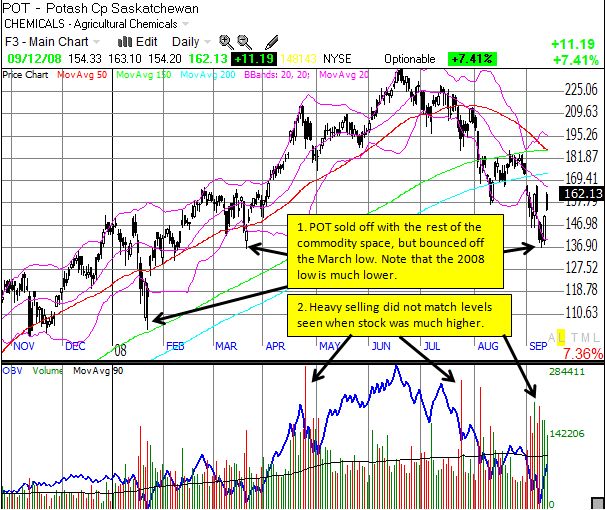

POT has put into place one price increase after in response to strong demand for fertilizer. In its last earnings report, POT claimed that the company's prospects are quite bullish at least through 2010. Last week's drop in the stock price brought POT back to flat for the year, but it has had an incredible run in the past 5 years. POT also went nearly straight up for the two years going into the all-time peak this past June. The forward P/E is a relatively low 7.6. POT's buyback sent the stock up 7.4% on the heels of a sharp bounce from the March lows. POT doubled the maximum number of shares in its existing repurchase program to 10% of the float or 31.5M shares. At current prices, this would equate to a whopping $5.1B. With cash holdings at $270M and debt at a massive $2.3B, I have no idea how this buyback will play out, even with a market cap of $49.4B. Perhaps POT expects the stock to reach even lower prices. Most likely, they do not intend to ever buy back this many shares. Anyway, while POT's long-term chart can give you nosebleeds, a move back above the 50DMA could signal the beginning of the next phase of the upward trend. I would wait until then before being a serious buyer of POT (or a retest of the 2008 low), especially given the "strange" math of this buyback.

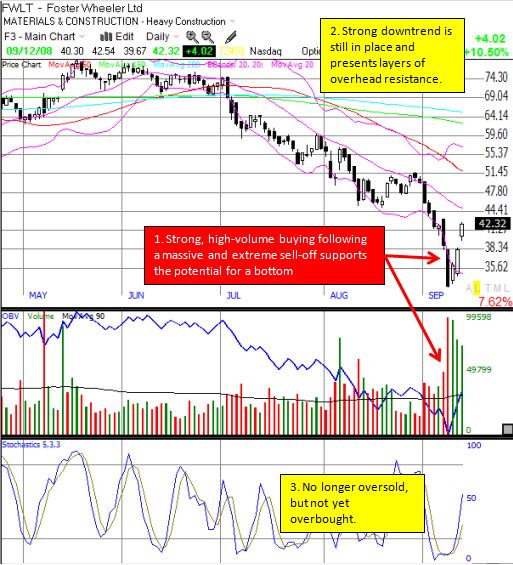

FWLT is an infrastructure company that caught my interest this year. Despite nearly consistent bullishness from the CEO, the stock stalled out right along with the rest of the sector. Jim Cramer recently got whiplashed trying to buy into the decline of the stock. For reference, note that he sold right into what looks like a climactic low printed on September 9th and 10th. Thursday's announcement of a $750M share repurchase program sent the stock up over 10% on Friday and seems to have confirmed that low. I want to be a buyer. Unlike JOYG and POT, FWLT sits on a cash hoard of $1.3B. That cash is 21% of the $6.1B market cap. Not shown in the chart below is that FWLT made 17-month lows, bouncing off support formed from closing a large gap higher in May, 2007.

In all of the charts above, the selling and subsequent buying have created very clear points to place stops. The biggest caution I have is that the size of the buybacks for JOYG and POT seem extremely large and sized more for demonstration than action. But this may be all the boost that is needed.

This is where it can pay to be a small, retail investor. We are typically called the "dumb money." But in moments like these, we suddenly can become the "smart money." Massive mutual fund outflows and bulging money market funds indicate many, if not most, of you have been stockpiling cash. You do not have irate investors demanding their money and forcing you to liquidate. You do not have to clear out the bad holdings in time for an end-of-the quarter review. You can buy put protection on core holdings without fear of driving up implied volatilities and/or driving down the value of your stock holdings. And, best of all, no bank allowed you to leverage up $30 to every $1 you (supposedly) own to pursue speculative debt instruments and other money-making schemes (no-money-down home loans not withstanding). Maybe you even heeded my lukewarm warning to "sell this rally until further notice" in the wake of the government's last attempt to intervene and prop up the market. Relish the moment and try to learn from the catastrophic mistakes of the "smart money." I will be looking for opportunity during the sell-off coming for this week and perhaps for weeks to come.

Be careful out there!

Full disclosure: Long JOYG. For other disclaimers click here.

Share