Click here to suggest a topic using Skribit. Search past articles here.

For 6 weeks following the March bottom, financial stocks enjoyed Teflon status. Dilution after dilution was bought and rewarded with higher stock prices. Bells were ringing confirming the March bottom. However in May, things suddenly changed. After a nice pop on May 1st, the financials have been selling off. From what I can tell, no big alarms are sounding in the financial press. Perhaps the roar of oil soaring above our heads has been drowning out the wincing of the financial stocks. Why should we care? Well, financials led us down to the January and the March lows. They also sold off ahead of last week's market swoon. The lower financials go, the more danger we should assume hides in the major indices.

I will let some charts do the talking about the warning signs that seem to be gathering around us. (Disclosure: I have or have had recent long and/or short positions in all of these names. See disclaimer here.) I start with financial stocks and end with some other important stocks that are failing the test. Finally, note that it is no accident that these warning signs are cropping up as the major indices collide with major resistance levels. We should expect some kind of bounce by the end of this week as last week's selling brought us close to oversold levels.

For starters, XLF, a financial ETF, is back at April lows, and looks to be heading lower for a retest of the January and then March major lows.

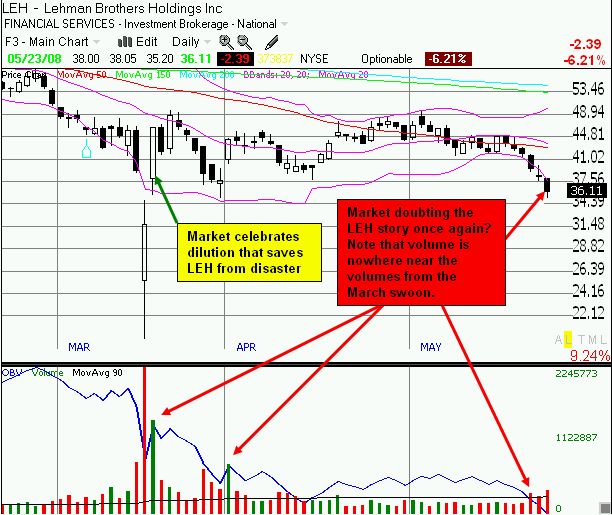

On March 18, 2008, Lehman Brothers (LEH) received a 46% pop as a reward for a multi-billion dollar dilution of shareholders. In 2 weeks, LEH had returned to the lows of that day. Last Friday, LEH returned yet again to that point. The last 3 days have seen high-volume selling and a notable pick-up in put-buying amongst a lot of negative analyst and hedge fund chatter. My personal opinion is that the market seems to finally be waking up to Lehman's compromised earnings power. Sure they are not likely to go belly up like Bear Stearns; the Fed has made it clear they will not allow it. But LEH is also far from investment grade material.

Back in March, I thought Citigroup (C) was setting up for a trading range between $19 and $24 or so. Citigroup spent most of April above this range. In May, C has traded nearly straight down to return to this range. Call this your second chance to get Citigroup at what has been called the bargain of a lifetime.

Bank of America has already cracked its March low and looks ready to set new 5-year lows (monthly chart).

In other news, the technical outlook for the homebuilders has taken a turn for the worse as multi-week support has cracked decisively and placed this index back under both its 50DMA and its 200DMA. A major test at the March lows approaches. Stubborn shorts who continue to bang on the homebuilders will get another payday. I continue to think the risk/reward for shorting homebuilders is relatively poor. A major homebuilder is likely going to go bankrupt (Wci Communities looks close again), but you have to be ready for a wild ride to make that kind of bet at this point.

I continue to say I cannot get "full bull" on the market until GE fills and rises above its ugly post-earnings gap down. Unfortunately, GE is headed in the wrong direction. Last week, we got an ominous 3-day breakdown from four-year lows. I think the market "has to" follow the financials and GE lower. Note that GE is a major component of the S&P 500 and generally moves in parallel with the index, but it LED the market lower to the last climactic low in March.

Finally, as many you faithful readers know, I like to use Google (GOOG) as a measure of the market's appetite for risk and speculation. While the NASDAQ was creeping ever higher for the first 2 weeks of May, GOOG was stuck in a holding pattern with prices drifting slightly downward. I thought GOOG was setting up for some low-volume consolidation that would lead to a new leg higher. Instead, GOOG dropped an ugly 5% on Wednesday and is back at the last break-out point in April. Next support is at $530 (post-earnings gap up) and $515 (50DMA). Each break of support increases my short-term bearishness on the (technology) market.

Be careful out there...!