click here to suggest a topic using Skribit

From worst to best to worst all over again. This best describes so many stocks that are hogtied to America's sinking housing industry and the looming credit crunch. While January marked the worst month in 18 years for the S&P 500, consumer-related stocks and various financials were top-performers. On Feb 1st, I did a quick review of the stats and noted that it seemed like the homebuilder's ETF, XHB, had finally broken its latest vicious downtrend. That break-out is now being tested as the XHB is back to flat on the year after being up as high as 21%. The boatload of shorts in the homebuilders are surely watching developments closely given that the 2008 lows are still another 20% away.

Washington Mutual (WM) represents one of the starkest "re-reversals" in fortune. WM was up 60% on the year on Feb 1st, but in less than 6 weeks WM is already back to a new 52-week closing low at a price not seen since 1995.

This is classic bear market action. In bear markets, often the worst stocks match their steep declines with some of the biggest rebounds. Typically, these breathtaking moonshots are driven by short-covering and/or premature elation over the prospects of a general recovery. In WM's case, shorts have remained undeterred in their pessimism. Shorts in WM have steadily increased for at least a year rose from 92.4 million shares on Dec 31, 2007 to a whopping 152.9 million shares Feb 29, 2008. And things indeed must be getting desperate for WM. S&P has been cutting ratings, and WM is supposedly looking to big pockets from the usual suspects of private equity and sovereign wealth funds.

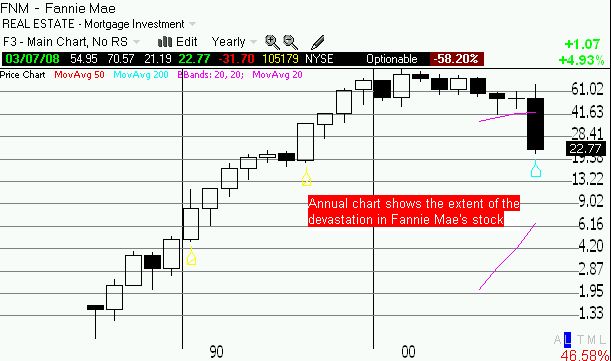

Fannie Mae (FNM) is another mortgage problem-child. FNM is now at prices last seen in 1995 (sound familiar?) and now down almost 50% on the year. On Feb 27, there was mass good/bad news confusion. First, FNM released its earnings report and warned that it sees mortgage delinquencies and foreclosures increasing through 2008. This should not have been surprising news, but the stock dropped at least 6% in the pre-market that day. In fact, almost two weeks earlier, FNM released its monthly economic outlook for February that reinforced pessimistic expectations for the housing market: "We project that the combination of below-trend economic growth and continued dislocations in the mortgage market will continue to slow housing starts and sales this year. We expect total home sales to decline by 22 percent in 2008 and single-family housing starts to fall by 30 percent in 2008. We expect housing starts and sales to stabilize in the middle of this year, with sustained gains beginning in 2009. However, the large number of unsold homes on the market is putting downward pressure on house prices. This price weakness is likely to extend at least through 2009." Yikes. But later in the morning on Feb 27, the Office of Federal Housing Enterprise Oversight (OFHEO) reacted positively to FNM's earnings report by announcing it "...will remove the portfolio growth caps for [Fannie Mae and Freddie Mac] on March 1, 2008." The stock was off to the races at that point. FNM jumped as high as 17% on the day before getting faded hard as the shorts and sellers regained control. FNM took another deep tumble this week along with the rest of the financials.

Add the near-certain bankruptcy of Thornburg Mortgage (TMA), and we are right back in the middle of a house of horrors for housing-related financial stocks.

Sure enough, last week, Fitch got even more negative on the U.S. banking industry: "Indications from rated banks in the past few weeks suggest that home equity delinquency rates are rising at a far more rapid pace than even most bankers' and analysts' grim outlook for 2008 had anticipated. Further, because of continued pressure on home prices, particularly in key markets such as California and Florida, severities (the percentage of the loan balance that is uncollectible) are rising and are often 100%...Fitch anticipates that banks will significantly ratchet up loan loss provisions against home equity loans in 1Q08 and provisioning levels for 2008 will likely be much higher than 2007 overall, as deterioration in other consumer portfolios is also likely." Note that Fitch already issued a negative outlook on the U.S. Banking industry in late 2007.

The ominous and dire headlines on housing just keep a-coming. The biggest recent headline spoke to the continued breakdown of the American balance sheet: "Home equity slips below 50%: Federal Reserve says homeowners' debt on their houses exceeds their equity for the first time since 1945." However, we also find out that home equity has been on the decline well before this most recent housing recession because of "...a surge in cash-out refinances, home equity loans and lines of credit and an increase in 100% or more home financing." In other words, this headline is just another part of America's increasing reliance on leverage just to maintain its living standards.

Let's try a thought experiment. Let's say it costs $100K to build a house, including the cost of land. The homebuilder uses prevailing market prices to capture a 100% profit and manages to sell the home for $200K. A year later, nothing changes in the community, but we all decide to pretend that the house is now worth $250K. We are collectively free to set our own prices because no one has the option to buy an imported home for a cheaper price that is more reflective of true value. The homebuilders are all too happy to sell homes at the new agreed-upon prices. During the housing bubble we never saw a himebuilder cry out for rationality in the marketplace. It is only when their industry is in sharp decline that they beg for rationality. Anyway, if no one can actually afford these high prices, the banks can develop creative financing packages to help support the inflated pricing: no money down, low interest rates now in exchange for higher rates later, and even 40-year loans...all to reduce up-front costs and get monthly payments to a manageable level. Bankers get large (projected) revenue streams and brokers get nice commissions. The Federal Reserve agrees to print enough money to loan to the banks to loan to us. Finally, foreign investors happily snap up securities based on these loan payments. Everyone is happy because the books say that all of this financial engineering is backed by an asset worth $250K, and everyone seems to come out ahead. But since the extra $50K is not based on anything - no new shopping mall, no new business development, no discoveries of oil or gold - this extra "value" can disappear as quickly as it appeared. All it takes is a shift in psychology and a shift in the economic trade winds will seal the deal.

Of course, something like this is currently underway. We bemoan the decline in housing prices, but these very prices are as high as they are now based on little else than our mass hysteria. Troubled homebuilders are free to liquidate by highly discounting new developments because there is plenty of clearance between current over-inflated prices and cost. Existing homeowners cry foul and consider abandoning ship rather than accept the new reality. After all, we were primed to think of soaring housing prices. Higher prices are a good thing for an investment, and we have come to treat homes much more as an investment than a place to live. The banks were ever so willing to make these expensive homes "affordable." But with so little equity in our homes, the investment thesis blows up, and we realize we can live anywhere else, especially somewhere else that is cheaper. The New York Times recently published an article explaining why it makes sense for some folks to walk away from their homes in "Facing Default, Some Walk Out on New Homes." Reading this made me realize that the recent frenzy to expand home ownership past the point of economic sense has had the ironic result of making people think of themselves more as "renters with risk" (a phrase from Nicolas P. Retsinas, director of the Joint Center for Housing Studies at Harvard University) rather than owners. Again, when homes are more investments than places to live, they are as disposable as a tech stock with a vicious price downtrend. Or even as disposable as a car whose depreciation has sent into junk status. If the price is not soaring, we can no longer withdraw cash from it, then it is time to hit the eject button.

So, it is no wonder that a growing number of institutions and people are ringing the recession bell. For example, JP Morgan has chimed in with its own dire warning in its recent 10-K filing with the SEC: "The Firm currently anticipates a lower level of growth globally and in the U.S. during 2008 and increased credit costs in all businesses...Economic data released in early 2008, including continued declines in housing prices and increasing unemployment, indicate that losses will likely continue to rise in the home equity portfolio."

The New York Times published an interesting article: "Downturn Tests the Fedís Ability to Avert a Crisis." This article provides a good summary of where we stand now. It talks about the current failures to fix the problems in our financial system and actually provides a glimmer of hope when comparing our problems to similar problems Japan faced when its historic real estate bubble crashed last decade.

I will end all this house of horror talk with some good news. Or at least as good as the news can get under these circumstances. Lehman Brothers (LEH) initiated coverage on the stocks of homebuilders with a "Positive" rating: "[Lehman] expects that the stocks could continue to be volatile over the next few months, as they do not believe that new home sales have yet reached a bottom. However, the firm is expecting trends to improve by the back half of 2008. As such, they believe that meaningful upside potential exists for several of the stocks in their coverage universe over the next 12 months, given that the group continues to trade well below its historical average valuation multiple. The firm prefers companies with healthier and conservative balance sheets and proven return histories. Firm initiates Ryland Homes (RYL) tgt $31, Toll Brothers (TOL) tgt $27 and D.R. Horton (DHI) tgt $18 with Overweights. The firm also initiates Centex (CTX) tgt $23, KB Home (KBH) tgt $24, Lennar (LEN) tgt $20, and Pulte Homes (PHM) tgt $15 with Equal Weights. Firm initiates Hovnanian (HOV) tgt $8 with an Underweight."

Be careful out there...and chiru!