Looks like the seemingly hot retail numbers from Black Friday could not provide the lasting catalyst to get us the oversold bounce I have anticipated in recent missives. So, while we wait around for some sign of sustainable life in this stock market, I thought I would revisit a thesis from May, 2006 citing evidence of a tiring bull market. It seems only fitting to do this because, even after the market rallies, the forces for selling into the rally will be strong and overhead resistance will be a lethal minefield. TraderMike gives a great breakdown of the nasty technicals that seem to point to an imminent retest, and perhaps violation, of the August lows. The one "encouraging" sign is the relatively low volume on Monday's sell-off.

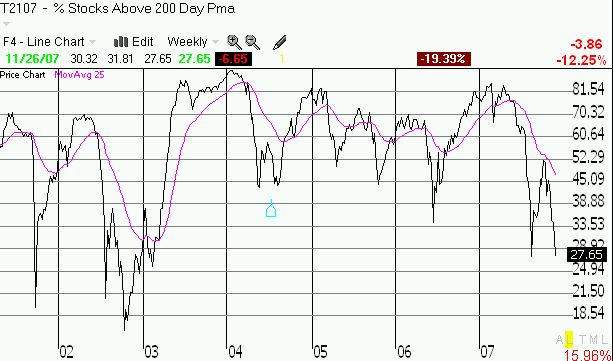

Last year, I used T2107, the percentage of NYSE stocks above their 200-day moving average, to build the case for the tiring bull. Sure enough, the stock market went on a month-long swoon that finally bottomed out in dramatic fashion in late June, about where I suspected it might based on T2107. The market got its rally shoes polished and tied after the Fed made what turned out to be its last interest rate hike. This rally convincingly suspended the bearish warning signs from T2107 and proceeded nearly unabated until the first sub-prime speedbump in March. While I was not able to profit much from the lovely prescience regarding the June swoon, the potential lesson of T2107 has stuck with me. 18 months later, the T2107 is again flashing warning signs, even as I look for the market to make a dramatic bounce to close out the year. The weekly chart below shows that T2107 is back to making new lows. Even more ominous is that if you remove the peaks in early 2007, the long-term downtrend in this indicator looks intact and ready to continue its journey to retest the ghastly lows of 2002!

So, pick your poison. Sell what you have left and get shaken out by the current swoon, try to ride the coming bounce, wait even longer and try to sell into or short the coming rally, or simply ignore it all and continue as you are. Everything hinges on some kind of catalyst. In 2006, it took the Fed to give the market clearance to break the T2107's downtrend. The next Fed meeting is not for another two weeks on December 11. Something tells me that the market cannot "wait" that long and will need some kind of hint, a wink, and a nod from the Fed to save itself from the increasing weight and burden of the downward pushing T2107. (Newflash - I just saw a WSJ headline stating that the investment arm of Abu Dhabi will inject $7.5 billion into Citigroup. Perhaps we can rally on hopes that our gas money will get recycled back into the US via major investments and purchases. After all, the dollar is so low, everything here must look like a firesale out there in the global economy!).

In times like these, I like to turn to GOOG's chart. (Read disclaimer here.) GOOG is a quinticenssential growth stock. When there is hope, cash is still flowing into GOOG. You knew money flowing back into the market was strong from late September to early November because big cap stocks like GOOG were running almost straight up. GOOG went from approximately a $167 billion company to a $232 billion company in a flash. The chart below shows that the steep selling in GOOG this month stopped cold at the 50 DMA support level and bounced nicely. But on Monday, an ominous bearish engulfing pattern emerged to give the bears some teeth. So, I think that just like the bottom in August, the market is NOT going to make it easy for the folks who want to stick around for the December fireworks.

Be careful out there!