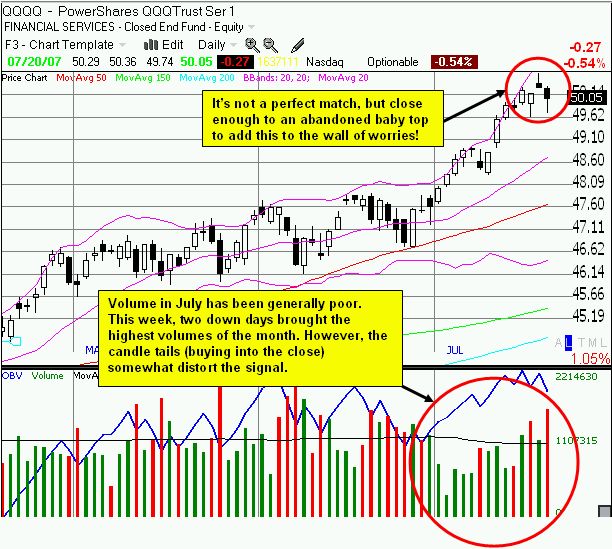

The market refuses to let me be bullish in peace. I was already concerned that the financial stocks continue to get whacked (GS was crushed below its 200DMA for the first time since last summer and financial indices like the BKX and RKH look like they are ready to complete a rounded top). TraderMike has pointed out several times how poor the volume has been on the major indices. Now, I noticed an ominous topping pattern in the QQQQ, the ETF for technology shares: the dreaded, but rare, abandoned baby top:

The signals are mixed on the S&P and the NASDAQ has an even sloppier abanadoned baby top. I watched earnings this week with extreme interest. Corporate earnings so far seem fine with companies like Juniper Networks (JNPR), IBM, SanDisk (SNDK), and railway company CSX Corp. (CSX) lighting things up. Stocks like Intel (INTC), Google (GOOG), and Caterpillar (CAT) did OK but disappointed relative to expectations, and each stock suffered. CAT in particular had execution problems, but they also repeated the often-heard refrain that growth in the U.S. is slow while global demand is strong. This reminds us that the U.S. is probably not already in a recession thanks to hot growth spots like Brazil, India, and China.

Homebuilder KB Home (KBH) announced that it does not see a recovery in the housing market until the end of 2008, thus pushing out the amount of time the rest of the economy has to hang on before the housing sector drags us into recession. We should also then expect the U.S. economy to remain sluggish through 2008. Companies like Whirlpool (WHR) and carpet and flooring company Mohawk Industries (MHK) had to admit that this domestic malaise is hurting overall performance. But oddly enough, on Friday we had a consumer-dependent company like Williams-Sonoma (WSM) hurtle upward on no news (perhaps some buy-out rumors? Bed, Bath, and Beyond (BBBY) also went up on a decidedly down day). Finally, financial companies like JPMorgan Chase & Co (JPM), Merrill Lynch (MER), and Citigroup (C) all succumbed to selling pressure post-earnings.

So, I want to stay bullish because of the persistence of the stubborn buyers in this market, but I cannot be bullish in peace given what I see as a wall of worry that is growing big enough to topple even the most optimistic scenarios. =Sigh= Such are the markets. Let's see what the next two weeks of earnings bring in.

Be careful out there!