The unemployment rate has been trending down sharply since it hit a recent peak in 2003 at about 6.3%. So, I was surprised by the market's surprise that the latest employment report showed yet another tick down in the unemployment rate to 4.4%...the lowest it has been since May, 2001.

The stock market was initially happy about the news of continued job gains for the common American, but the appreciation faded faster than it appeared. Instead of joy, the market chose to focus on the fading prospects for a near-term rate cut. In fact, the smarter pundits and analysts in the crowd spoke about the possibility that the Fed will need to raise rates one more time given the persistent strength in the economy. As you faithful readers know, I have long been in the camp of folks calling for yet another Fed rate hike. And even though the case for such a hike remains a bit tenuous, I continue to marvel at the logic which declares that we need a rate cut. The economy continues to hum right along, and there appear to be a lot of jobs out there for anyone who wants one, especially for skilled and well-qualified workers. Why on earth should the Fed cut rates? As I have said in the past, this is the market discounting mechanism working at its worst. The market is thinking too many steps ahead. (According to the WSJ, the futures market dropped the likelihood of a Fed cut by April, 2007 from 56% to 14% on the heels of the jobs report). Let's at least wait for a recession to look likely before making predictions about a rate cut. The market is so eager to rationalize this recent rally that it is, in effect, grabbing at straws. Let's enjoy the good economy NOW, hope that it continues, and use THAT as the excuse to buy stocks. Why is it better to rally on the expectation of economic weakness and rate cuts?!? Madness, I tell ya. Anyway, let's move on to the main topic of the day...before I start sounding like I am part of the 50% of Americans (according to recent polls) who support President Bush's economic policies (=smiles=).

This past week, many retailers reported monthly sales figures, earnings, and/or expectations for the coming holiday season. It created a storm of news for retailers. I want to zoom in on a two stories that I find particularly interesting.

First, Best Buy closed the week in poor fashion with some of the most active selling it has seen since the days before it reported earnings in early September. At that time, I reported that Best Buy confirmed the notion that the consumer is far from dead. I also warned that the subsequent rally in Best Buy was overdone because it seemed that Wal-Mart (WMT) would soon be forcing profit margins down for consumer electronics. Wal-Mart had been actively running commercials taking direct aim against the high prices at Best Buy. The market chose to ignore these warnings until Friday when Wal-Mart made its intentions official. In a news release neatly titled "Wal-mart Turns Up Holiday Savings; Turns Down Prices on the Coolest Electronics", the discount retailer announced that it is turning up the heat to compete for consumer dollars this holiday season: "Wal-Mart continues to brighten the holidays for families everywhere with significant price rollbacks on nearly one hundred of the season’s must have electronics—the second set in a series of price cuts on thousands of key gift, entertaining and holiday goods. Key merchandise -- rolled back at Wal-Mart in the month of November through December 31-- includes High Definition Televisions, digital cameras and cell phones." You should read the rest of the news release for specific examples of discounted products. Take very careful note. These products are the very same products that provide Best Buy its highest profit margins. We should not be surprised if Best Buy's next earnings report fails to meet expectations, and we should be even less surprised if the company guides down for the holiday season.

The market's reaction to Wal-Mart's news was swift as Best Buy's stock dropped a point in one hour's time before recovering into the close. Do not be fooled by the recovery or any analysts who rally to the defense of BBY by whistling past the graveyard saying things like there are plenty of consumer dollars around to share or that the two companies cater to completely different customer bases. I just bought a DVD player at Wal-Mart and was impressed by the pricing and the improved selection of brand names. Things are likely downhill from here for BBY's stock. The selling has taken the stock down to support around the 50 and 200 DMAs, and the highs last seen at the close after BBY reported earnings. I imagine the optimists will rush in to defend these levels as long as they can. Good luck...

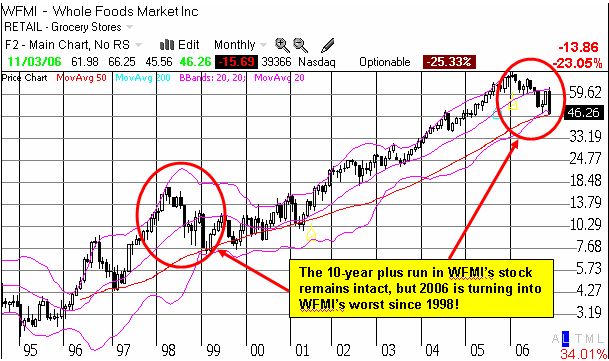

The second story for the day is Whole Foods Market (WFMI). WFMI could be the 2006 poster child for mislpaced optimism and misguided bottom-fishing (at least until homebuilder stocks start selling off again). WFMI reached its all-time peak at the end of 2005 and proceeded to break down for the next seven months. The "death blow" came at the end of July when WFMI delivered a very disappointing earnings report. Actually, WFMI reported the kind of growth and future prospects that would be the envy of many stores and outlets nationwide. WFMI has the misfortune of being an expensive "growth" stock, so expectations for the company are/were stratospheric. So, it should come as little surprise that after the reactionists finished taking the stock down another 12% for a 52-week low, the "contrarians" and "optimists" began to crawl back out from cover and proclaim the stock an amazing bargain and a steal. For example, the very next day RBC Capital Markets reiterated an "outperform" rating. But when the ebullient Jim Cramer on August 3rd cautioned his flock to stay away from the stock, it seemed the feel-good story could actually be coming to an end. Indeed, WFMI fell another 10% over the next two trading weeks. Next, Barron's called the stock "cheap." Here is the crux of the argument as reported by briefing.com:

"...But with the shares' most recent slide, sparked both by the sales dip and concerns that square-footage growth is slowing, the stock's p-e multiple has fallen to 34 based on this year's earnings, and 29 times fiscal '07 estimates of $1.64 a share. That's about what it was in March 2003, before the big run-up. Another doubling of the shares is by no means guaranteed. The stock's valuation is still high compared with other retailers, and the shares are vulnerable to any further signs that sales growth is tapering. In recent years, sales generally have grown at a mid-to-high-teens rate. And, as Wal-Mart's (WMT) entry into the field suggests, more competitors could arrive on the scene. But, because Whole Foods has turned grocery merchandising into something of an art, it may be sheltered from competitive threats."

And with that ringing endorsement the stock was off to the races. The stock gapped up strong that Monday morning and soared for the whole week - almost recovering all post-earnings losses. All told, the stock gained about 35% as more and more folks dared to ride the "recovery" story. Unfortunately, last Thursday's earnings report confirmed what was already apparent during the last round...WFMI's growth no longer justifies a premium valuation. The headline numbers do not seem poor on the surface: 1) last quarter was in-line, 2) guidance on same store comps at 6-8%, below expectations, and 3) 2007 revenue guidance cut to $6.3 - 6.6 billion, below the $6.8 billion expectations. But remember, this is a stock with a premium valuation. Retailers are doing good with half the P/E that WFMI was awarded. And WFMI sells food, typically the lowest of the low in retail. For example, Safeway has a forward P/E of 15. Sure WFMI sells gourmet and premium fare, but I strongly suspect that one day soon WFMI's P/E will be "normalized" to that of other food outlets. Regardless, the come-uppance with this latest signal of slower growth was even more harsh and more swift than the last time. WFMI fell 23% on Friday, straight down to a new 52-week low...WFMI has now just about erased two years of gains...sitting at prices last seen at the end of 2004 and the beginning of 2005. I will be very curious to hear what Barron's has to say this time around, but so far, a whole host of analysts have downgraded the stock and no analysts have stepped up to defend the stock yet again. This is understandable. How many more warnings will it take to get the point across, right? Now, there are a lot of "trapped" bulls who need to unload this stock as soon as possible without creating even more sickening drops in the stock price. Good luck...

So what does this all mean? I think the consumer is still fine, but, for whatever reason, consumers up and down the spectrum are getting more and more careful with their pennies. Certainly, consumers in certain sectors are losing their appetite for over-priced products and will demand more bargains. There are retailers like Wal-Mart who stand at the ready to accomodate such shifts in price tolerance. The coming holiday season will be an excellent barometer of what is really going on. Until then, be very wary of retail stocks, especially those that have soared to the sky in the past few months in anticipation, of, well, of what, I have no idea. We are supposed to be having an economic slowdown soon....

Be careful out there!