As the market continues to sell-off, I am sure you faithful readers are wondering whether I am ready to declare a "spare the despair" day. It sure feels like despair has reached unsustainable levels. Surely we are closer to a bottom now than the top. Use your favorite indicator(s), but the ones I showed two days ago are now reaching levels that indicate that buying into further weakness should make for a decent trade (even if not for a good investment!). I am sure my man TraderMike will hook us up with some timely technical interpretations as well. However today, I will not concern myself with prognostication. Instead, I wanted to provide a guidemap that should prove handy as the latest madness in the market intensifies, ebbs, flows, and spilleth over.

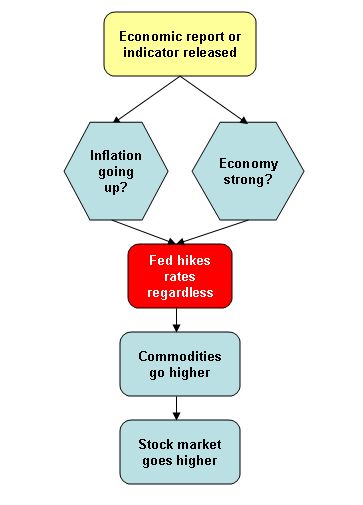

All the while the Fed was raising rates, the market laughed and scoffed. Long-term rates actually went down, the stock market went up, and the economy built stronger muscles to live to deflect the Fed another day. For example, this contrary behavior helped keep expanding the housing bubble long past its welcome. The simplified diagram below summarizes in stylized form the fairytale dyanmic we enjoyed:

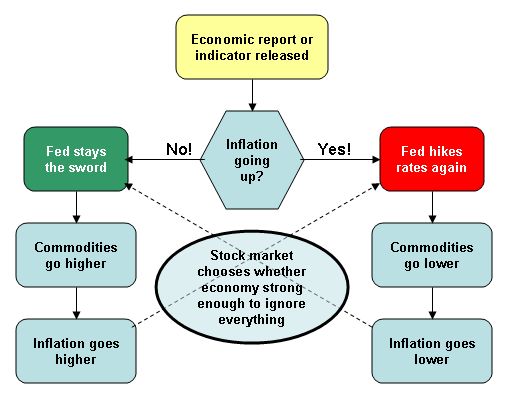

Suddenly, the Fed has declared that it is no longer certain whether it will continue raising rates, but it will watch the data for clues. Now, monkey see, monkey do, and we find a market on edge waiting to jump and react to every economic report. Suddenly, we can no longer count on the market merrily skipping along independently of these reports:

The above diagram shows the first source of madness. Before, the market did not need to care what the inflation indicators said, and it did not need to worry about what the Fed did: it was free to go up whenever it decided to go up. Now, we have a process that if left unchecked can promote wild swings from optimism to pessimism (we currently have a wild swing toward pessimism). The new conundrum is that selling commodities and stocks out of fear that the Fed will raise rates further in the face of dangerous inflation data will in itself serve as a force to dampen the very inflation everyone fears.

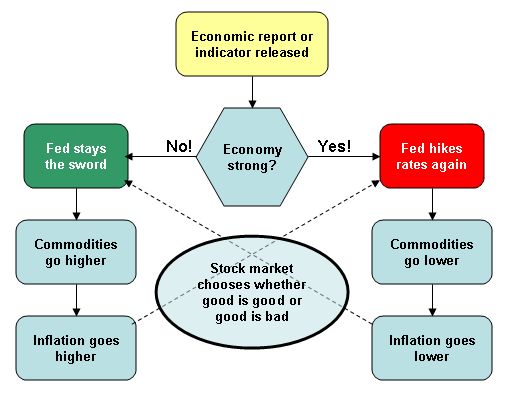

This last diagram shows that the same maddening dynamic is at work when it comes to worries over a strong economy. As we have seen in the past when the market gets into this mood, the market can choose to interpret good economic news as bad and bad news as good. Since the market will choose its reaction based on its mood at the time, we should expect to see wild swings hurtle out of reports on the economy's health.

I have of course simplified the economic discussion, but the basic point is that we are now held hostage to the headlines in a way that we have not seen in a while. We cannot be sure how the market will react to any given piece of news because the Fed's actions from the data will be uncertain. We are at a point of near maximum uncertainty: we can interpret the numbers incorrectly, we can miss the true trends, we can interpret the market's reaction to the interpretation of the numbers and trends incorrectly, and moreover, we can interpret the Fed's likely reaction to both the news and the stock market's reaction incorrectly! Whew! What are rates on CDs and money markets these days...? =smiles=

As always, be careful out there!