|

|

Sometimes the market responds immediately as expected. I looked back over the past two weeks of market movements and was surprised to note that just about every stock I reviewed that had something to do with natural resources started downward the day after the last Fed meeting. At that time, I wrote a note (contrary to the rampant Fed optimism at the time) claiming that the Federal Reserve is now signaling that it is going to try to knock resources down. Sure enough, traders got the hint, even if the media did not, and they have been selling these stocks ever since. (Frank Cochrane, President of Investment Timing Consultant, appeared on Nightly Business Report on Friday, February 10, 2006,and he provided a nice list of reasons explaining why the Fed is not yet done). The selling seemed to reach intense levels at the end of last week, so I suspect some kind of bottom is nearby. I also suspect that the Fed has been raising rates too slowly and will be caught flat-footed as increasing prices of commodities and energy start to flare throughout the economy. Friday's news that the American trade deficit has reached yet another all-time record reminds us again that the spending power of the American economy remains strong. The irony is that the Fed would have to drop interest rates to cool down our ability to buy foreign goods and services. Could another conundrum be around the corner? Note this would be a very strange scenario since the Fed hopes that higher rates encourage more saving and discourage spending. But if so much of what we buy comes from overseas anyway, the Fed will have less control than usual to cool off demand.

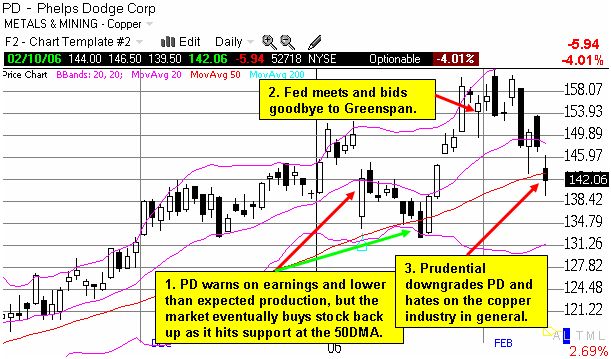

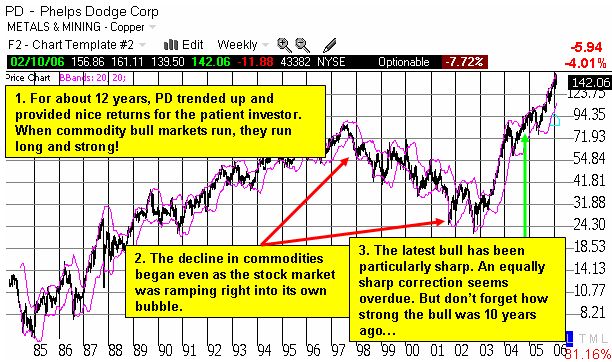

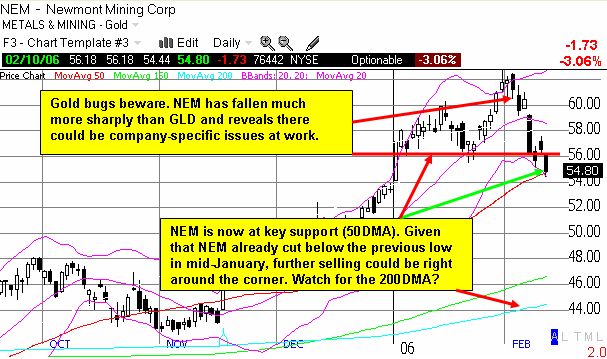

I use the charts of Phelps Dodge (PD), a major copper producer, and GLD, the gold ETF, to tell part of the story in resources (see disclaimer here regarding discussion of individual stocks). I like PD because it warned about disappointing results, and the market bought the weakness. The buying was so strong that the stock eventually went right back to all-time highs - right up to the actual earnings report. The stock rode the willing backs of positive analyst commentary, and I suppose the market bought up the stock in anticipation of dovish commentary from the Federal Reserve meeting. However, the tide has turned in these past two weeks with pressure from the Fed reality, the actual earnings report, and a big downgrade from Prudential all conspiring to knock the stock back down. However, note well that the sharp up-trend of late has NOT been broken. Gold stalled out immediately after the Fed meeting and last week took a small tumble. Stocks like Newmont Mining (NEM) took the dip even harder. NEM is already 13% below its all-time highs and is threatening to dip below its 50 day moving average (DMA).

Be careful out there!