TraderMike says it well: the market looks tired. I read his piece before heading to the gym for the night...fighting off my own fatigue to get some much needed exercise. The gas stations along the way were all showing lower gas prices again. In fact, for the past two weeks or so, it seems to me that prices have been in steady decline. I think we are down 15% or so from the recent highs. Could the oil and gas sector be tired out? Perhaps "tickling threes" produced prices that even the staunchest gas-guzzling SUV drivers could no longer tolerate? Hold me back before I fall flat out of my chair.

In past missives, I have been almost cavalier in my dismissal of any notion that oil was stretching the upper limits of a price range. I have been an admitted bull on the sector and have looked to buy on any dips. The past three weeks have featured a slightly different pattern in this sector than we have seen in a while: sharp volatility with high volume sell-offs and equally sharp and violent rallies. I know my stomach was churning and my head burning from the madness. We even had rumors last week of some big players doing some massive liquidations of large positions in Exxon and Chevron stock. The energy copmanies themselves were supposedly scrambling to sell long-term futures that were driving even the price of 2010 contracts sharply downward. The fear and panic surrounding this phase of the oil and gas sell-off smelled a lot like a bottom to me, and I only got more confident in holding through fire. Monday and Tuesday's strong rally seemed to validate my convictions as we got the first consecutive up days all month in the sector. Today, however, as TraderMike pointed out, the major indices neatly reversed right at important resistance. Oil and gas was not immune. I post a chart of XLE, the "spider" for the energy sector to highlight the action:

I post this chart to demonstrate just how much drama has played out in the energy sector. Pull up almost any chart of an individual stock in this sector, and you will see very similar patterns. The fundamentals still appear strong, but for now, this entire sector will remains held hostage by short-term panic and elation as folks watch even closer every tick on the price of a barrell of crude. We also have big institutions playing this sector like a basketball bouncing stocks up and and down and all around the court to and from each other. I hope at some point to get some time to talk more about some of the drama playing out in individual stocks. In case you want an advanced preview, I will give you some names to check out: VLO, TSO, UPL, XEC, XTO, CVX, XOM, ECA, CGO, CHK, SWN, WFT, and CDIS. This is just a small sample of the universe. In the meantime, pay close attention to whether key points of resistance and/or support hold up around the 50 and 200 daily moving averages.

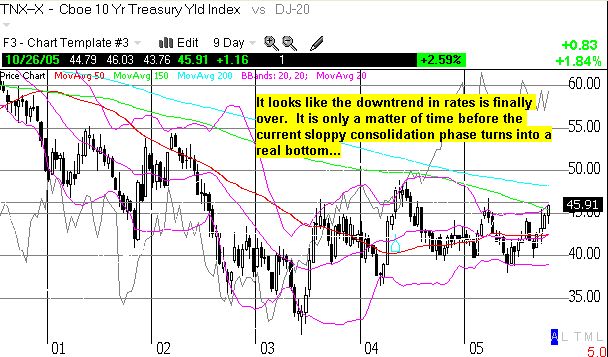

So, the market's sharp rally on Monday has now given way to the fatigue mentioned earlier. Throughout the never-ending churn we have endured on the way down from the July/August highs, we have gotten much loved rallies with absolutely no follow-through. This week has featured more of the same. There is one important difference that demands our attention: interest rates are breaking out...again. The 10-year bond is now at 4.591%. While we have seen this story before in March of this year and also mid-year in 2004, I strongly suspect that the bond market has finally gotten tired of waiting for inflation to smack it upside the head. With common sentiment indicating that our new Fed chairman will be soft on inflation, the bond market has swung into action. Today marked a break-out of sorts in yields. If we punch through the highs of this year, well, I will just say I hope you bought your house already on a fixed, long-term interest rate. Just like oil, rates are going higher.

The short-term view clearly shows today's breakout in interest rates. The longer-term view below shows that we are reaching critical resistance. Punch through this and we can kiss the era of low inflation and low interest rates good-bye until another generation or so...at least. Cyclicals, like housing and industrials, beware. As soon as you can, grab your nearest gold bars and other commodities and hold on for dear life.

Speaking of being tired...maybe, just maybe, the country is finally getting tired of the circus that gets uglier and uglier in Washington, D.C. This week, we had to honor the somber marker of having lost our 2000th soldier in Iraq. Even as we do so, Iraqis are almost daily mourning the latest disastrous terrorist strike. The unabated violence may have become mind-numbing for many of us, but it is all too real for everyone on the ground out there in the land of missing weapons-of-mass-destruction. To make matters worse, we are spilling American blood to protect what is turning out to be massive corruption, waste, and fraud in how our tax dollars get spent in "reconstructing" Iraq. Even the American Conservative has written an expose on this morass called Money for Nothing." The latest news on senseless waste came several weeks ago that Iraqi officials sought the capture and arrest of about twenty high-level government officials who apparently had absconded with at least a cool billion dollars in tow, scraped right out of the Iraqi defense ministry. Back at home, we have our growing list of scandals, waste, and fraud. We have a whirlwind of political activity, gaming, and scandal that has certainly grown more sensationalistic than even the kinds of stuff we saw during the past two or three administrations. As Bush watches his poll ratings continue to dive, he sticks to his typical stubborn refusal to admit that anything is wrong, an air of oblivious hubris that he tries to mask as courageous determination. I tried to extend him the benefit of the doubt when he FINALLY chose to admit that *something* had gone wrong in the response to the Hurricance Katrina disaster. Well, that silly honeymoon ended before it ever really got started. Even Bush's own party is showing its thinning nerves in its growing opposition to his latest choice for the Supreme Court - a candidate we are supposed to like because she has ZERO judicial experience. What an appropriate marker for this administration - one more crony added to the mix. I wonder what future blunders await us if this nomination actually passes. At this point, the Democrats can just sit back and watch this whole ship sink faster and faster. America is getting what it paid for. Too bad the costs are extending far past the folks who actually voted our main man in for another round.

Anyway, I mention all my typical anti-Bush diatribe to reinforce this notion that we are now in an environment of fatigue. It is seeping through our bones and permeates the air. Hard to tell how all this might play out, but if things start to sink further in the financial markets, I strongly suspect the downside will come quickly and sharply...before most of us can even think to react or move to protect ourselves. Perhaps at that point of maximum concern, we will get a turn in the market...again. But all indications confirm that the slow growth, low-return economy is here to hang out with us for a while.

Be careful out there!

© DrDuru, 2005