If Some

Hedgies Are Blowing Up, Bring On the Dynamite

By Duru

May 16,

2005

The

conventional wisdom out there says that there are

one or more hedge funds out there blowing up after taking on too much risk.

These naughty boys and girls have fiddled

around with exotic credit derivatives, spreads, aggressive bets on cyclicals

and commodities and what-not. If someone

is blowing up, you could not really tell by looking at the indices. My man, Mike, noted that the major indices

have essentially gone nowhere during these rumored blow-ups. And now today we find ourselves with a Nasdaq

knocking AGAIN at the door of the magical

1999 for a 3.5% gain in the first two weeks of May. Heck…if this is what happens when disaster

strikes in the market, let's bring on the dynamite and really get this party

started!

OK…I am being

a bit glib, but I always get fascinated by the contrast between the conceptual

notion of blood in the streets versus the reality of a calm, albeit churning,

market. Certainly, this slow steady monotony is the

way frogs get boiled, but for now, it is easy for the casual observer to

wonder about the source of all this fuss.

I wrap this

quickie note with some charts that caught my interest tonight. I did not annotate, so I will trust you to do

your own admiring, ooh'ing, and aah'ing.

I will introduce each chart though…

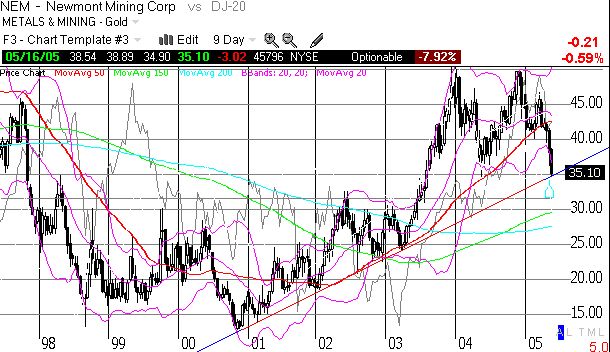

NEM: While gold is blowing up along with the rest

of the commodities out there, NEM finds itself at a fascinating juncture. It

conveniently stopped right at the up-trend line. The second chart shows the short-term daily

chart of NEM…and it is quite ugly indeed.

Note carefully the test of the 2004 lows which themselves tested

successfully an important gap up in July, 2003.

The Dollar: To increase the drama on gold, the dollar has

been streaking hard in the past week. It

now looks like a true jailbreak over the 200 daily moving average. I will stick to my skeptical ways and grumble

that I smell a head-fake. Isn't the market now hoping that the Fed is going to

slow down and stop hiking rates soon? Go gold! (Besides, how could Warren

Buffet be wrong, right?!)

Energy Sector: The energy sector has gone from

market leader to injured reserves. A steady, grinding down-trend has been in

place since the highs of early March, even featuring numerous head-fake

snapback recoveries. Today, I am taking

special note of a pattern that can lead to more lasting snapbacks. Check out

how XLE, the ETF (Exchage-Traded Fund) for the energy sector, has sold off on

high volume for three days in a row with the third day featuring a decent

comeback. That third day has printed a

pattern called a hammer. Typically, you

prefer to buy this during an up-trend.

In this case, we are not only in a short-term downtrend, but the 50

daily moving average is even beginning to turn downward. Sounds like a great time to make a contrarian

move now that everyone seem to be licking their chops for ever lower oil

prices.

SBUX: Remember when I "quasi"-tried to call a bottom in this beloved

barometer of caffeine addiction? I

was watching the long-term up-trend line like a hawk and figuring there was

little chance that buyers and bulls would let this one escape through the

hatch. Escape SBUX did and for over a

10% drop below the long-term up-trend line.

Stock has since gone almost straight up in a very nice recovery as the

news has suddenly become as good as it was bad just a few weeks ago. Talk about manic! As SBUX hovers around that old up-trend line,

it faces a crucial test of mettle. A

further move from here could re-establish some well-deserved luster to this bad

boy.