Intel Redux

By Duru

December 4,

2004

Well, I'll be!

My prediction of a positive response to Intel's

mid-quarter update came through and even surpassed my expectations for the

first day's move. However, I am not writing this quick follow-up to bring more

attention to this fortunate call. Instead, I thought a description of the day's

action and some thoughts on what could be next would be helpful.

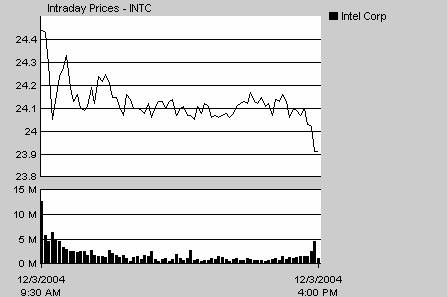

The first

thing to note is that although Intel jumped over 7% on Friday, the 1.75 point

gain was quickly trimmed to a 1.3 point gain and increased selling into the

close took the stock down for a 0.6 point loss (2.4%) from the initial highs.

See the simple line chart below (from www.moneycentral.msn.com):

So, if you had

bought Intel immediately out of sheer excitement from me actually clocking this

one perfectly, you would now be cursing the day you ever read a single word on

this site! It would be easy to call you shortsighted and overly focused on the

small random moves of one day's action. But there is an important lesson here

that I wanted to point out. In my last piece I focused on the action of the

stock, but I did not give any attention to the options. A quick glance at the

options pit would reveal that speculators and traders were crowding into the

bullish camp over Intel's prospects. Even while the stock was declining into

the mid-quarter update, folks were snapping up calls like they were going out

of style. More specifically, as Intel declined from the previous peak the

put/call ratio actually dropped. Instead of generating fear,

the decline in the stock was treated as an enormous buying opportunity. Options

traders took the put/call ratio down from 0.54 to 0.46 in a little over a week.

For additional perspective, this put/call ratio was at its lowest level since

late April, 2003, and it finally cracked support that had held admirably since

February, 2004. (Go to Schaeffers

Research to see this data and more).

This put/call

action effectively means that bullishness in Intel was actually reaching highs

not seen in a very long time. It also means that the bullish bet on Intel's

mid-quarter update had gotten extremely crowded. For those folks fortunate

enough to load up on calls in the past few days, the big pop meant a windfall.

For those who bought these calls earlier, they probably had just gotten back to

about even, or at least a lower loss. Finally, the stock itself instantly

rallied right back to the resistance pointed out

in the last piece. Certainly the lackluster jobs report must have dampened

interest in Intel (more on that stat later?!), but I will assume for the sake

of argument that stock-specific factors were the most important here. In sum,

we had the perfect set-up for some selling on the news. The subsequent drop in

the stock should have been expected and folks making a one day bet would have

been very wise to join the sellers.

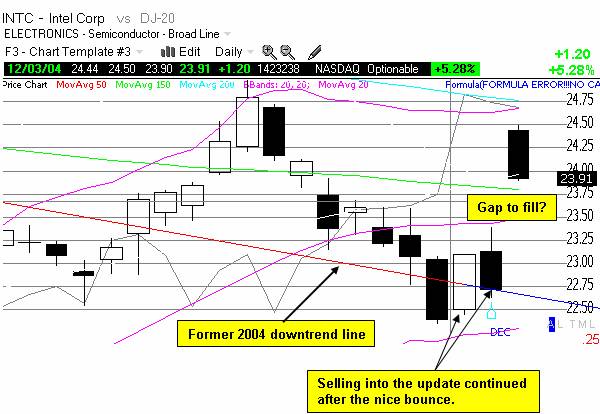

The more

important question now is "what's next?" Of course, none of us can

predict the future, but in thinking forward you should keep in mind all the resistance and support levels mentioned

before. Added to the mix now is this gap created by Friday's trading. The

stock has already begun to fill it, and current momentum suggests the gap may

slowly but surely be filled. A close-up of the daily action is shown below with

a candlestick chart (chart from TC2000):

Also, the

bullishness in the options remains extremely high. I would have expected the

open interest in calls to go down as folks cashed in…instead, open interest in

calls (and puts) actually increased on Friday. This means that options traders

are on-balance willing to keep pressing the bet - even as stock traders seem hesitant

again. The bullish camp effectively remains crowded. Thus, I suspect Intel will

be good for some further slippage to $23.50 or so. After a bit more fear slips

into the trading, Intel should be ready to rebound, attack, and break, that

hard resistance sitting around $25. A break of this triple-stacked resistance -

200DMA, upper Bollinger Band, and two previous highs - could be the watershed

event that marks the beginning of another sustained rally for Intel and

probably the entire semiconductor sector. Hard to tell how long it will take

for the market to give us some answers, but I suspect that within a month's

time, we should find out whether to let out another rally call or to dry our

tears before reaching for the "shorting button." For now, my overall

bias remains bullish (disclosure - I no longer hold my position in

Intel).

Please

note that any decision you make to buy or sell Intel should not be based solely

on what you read here. Please consult the appropriate advisor before making any

trading or investing decision.

Be careful out

there!