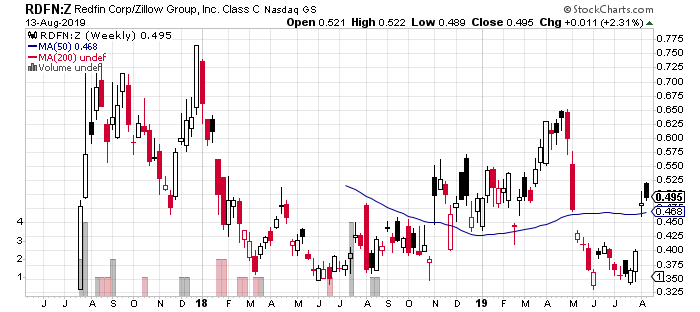

Realtors Rebound Despite Housing’s Supply Shortage

I heard this tweet referenced twice in the financial media: the first time unsourced and the second time sourced. I must assume that the bizarre data points of the U.S. housing market from Glenn Kelman, Redfin’s CEO, went viral. Redfin’s commentary and observations on the housing market are typically astute and insightful, but this particular … Read more