Parabolic Gold and Crypto In Focus with Looming Debt Drama

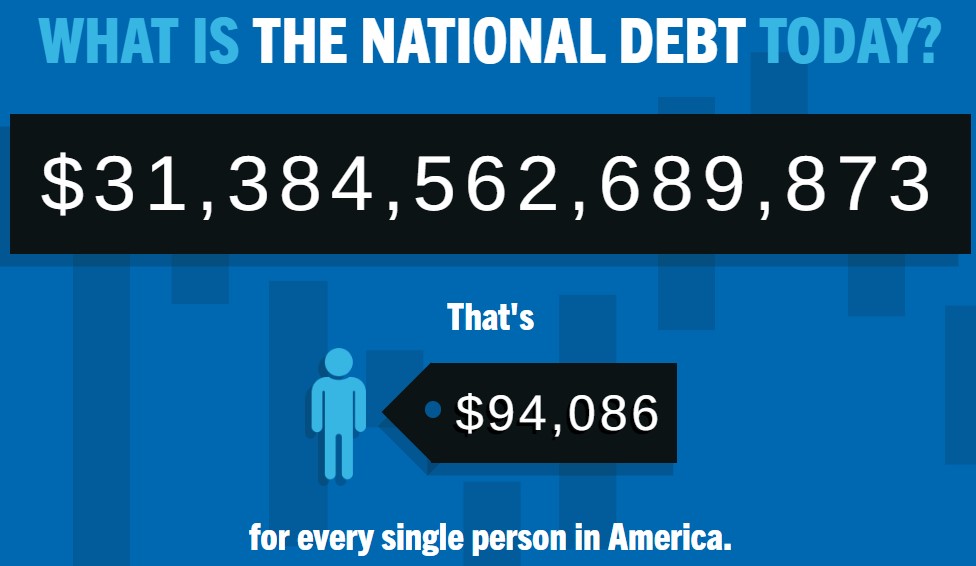

With the power change in the U.S. House of Representatives, 2023 will be another year of drama over the U.S.’s debt ceiling. Treasury Secretary Janet Yellen recently brought the looming debt drama to the forefront of economic headlines by delivering the obligatory warning about the risk of default if Congress does not increase the debt … Read more