Nutanix: A Stock and Company Ready for a Takeover

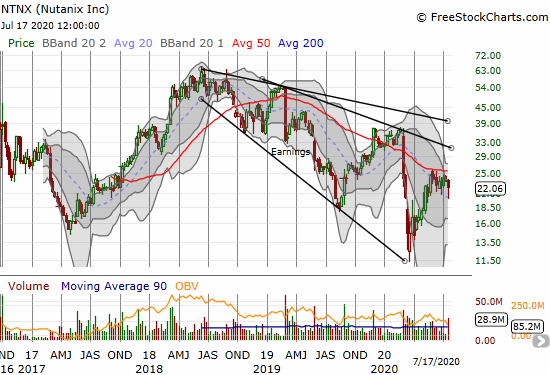

Nutanix (NTNX) is an IT infrastructure company that helps its customers “modernize their datacenters and run applications at any scale, on-prem and in the cloud.” The stock peaked in June, 2018 after a 13-month, 310% run-up from an all-time low. The March, 2020 stock market crash briefly took NTNX to a new all-time low. Even … Read more