Stock Bulls Taunt Suddenly Hesitant Bears – The Market Breadth

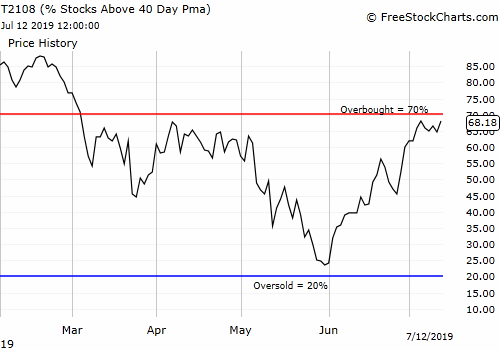

Stock Market Commentary A decisive end to the extended overbought period signaled the arrival of bearish conditions last week. Bears boldly sold for one more day before a “stock bulls taunt” forced suddenly hesitant bears into a partial retreat. A sharp market divergence is now taking hold. While the major indices rallied off support and … Read more