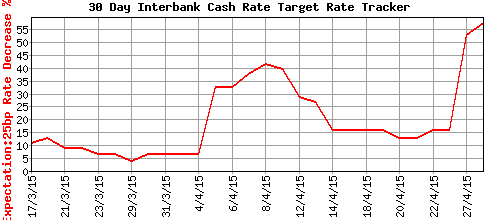

The disappointing inflation numbers for Australia did not just take down the Australian dollar (FXA). Financial markets also rushed to ramp up the odds of a rate cut in the next policy meeting for the Reserve Bank of Australia (RBA).

Source: ASX RBA Rate Indicator

Even if the RBA takes a pass on a rate cut in May, futures markets are still pricing in a rate cut as early as July or August (pdf). The drop in the Australian dollar and the increased odds of a rate cut likely go hand-in-hand.

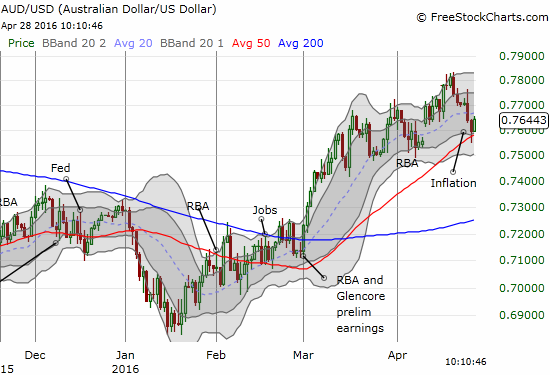

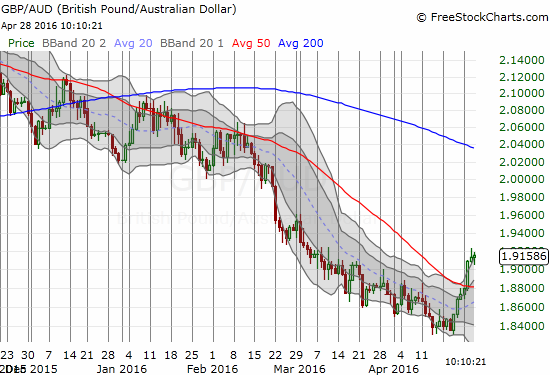

Against the U.S. dollar, the Aussie has found some support at the rising 50-day moving average (DMA). However, more importantly for larger market implications, the Aussie is still tumbling hard against the Japanese yen. The change in trading in GBP/AUD is made all the more dramatic by the recent change in trading behavior on the British pound (much more bullish!)

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long EUR/AUD, short GBP/AUD, short AUD/JPY