(This is an excerpt from an article I originally published on Seeking Alpha on November 19, 2015. Click here to read the entire piece.)

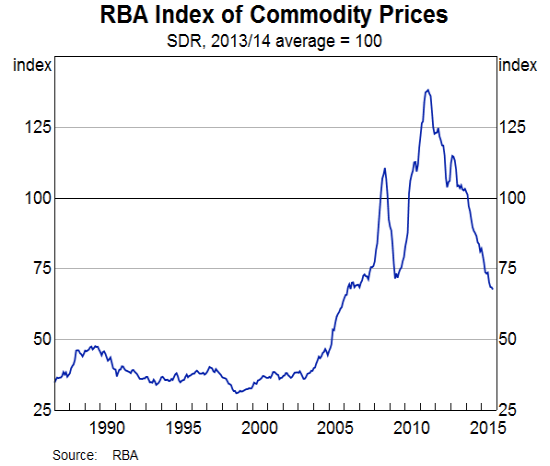

“…the changing nature of China’s development implies that the potential for commodity prices to rise from here is somewhat limited.” – Christopher Kent, Assistant Governor, Reserve Bank of Australia (RBA) at the UBS Australasia Conference, November 17, 2015.

Kent of the RBA did not provide a specific forecast of commodity prices or a breakdown of different commodities, but this one sentence was sufficient. {snip}

Source: Reserve Bank of Australia – Index of Commodity Prices, October, 2015

This perspective implies that commodity prices could continue to fall and still deliver a strong overall growth rate from what was at least 20 years of a tight band of pricing. {snip}

A lot of course depends on the speed, depth, and breadth of China’s economic transformation. Kent notes that China’s industrial output has naturally declined in the face of over-capacity in housing and infrastructure. Moreover, China’s economy is maturing from a reliance on manufacturing and exports to services and domestic consumption. {snip}

In parallel with Kent’s remarks, Nev Power, the CEO of Australia’s largest homegrown iron ore miner Fortescue Metals Group, licked his chops at the prospect of an imminent bottom in iron ore. Power foresees a looming moment of truth for his big competitors when cash flows no longer support continued over-investment in capacity. {snip}

Of course, Power is eager to convince the market (and himself) of an imminent bottom in iron ore. The price of iron ore has retreated significantly from its latest relief rally. {snip}

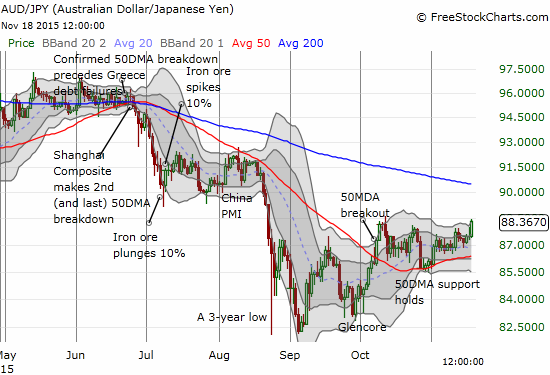

In the middle of this back and forth is the Australian dollar (FXA) which sometimes trades as a proxy for the market’s expectations for commodity prices, particularly iron ore which is still Australia’s largest export. {snip}

Source: FreeStockCharts.com

On a related sidenote, the U.S. Federal Reserve expects energy prices to start increasing soon. {snip}

Be careful out there!

Full disclosure: short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on November 19, 2015. Click here to read the entire piece.)