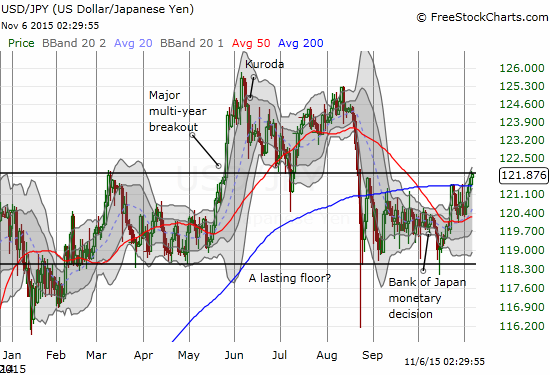

As the hours count down to November’s jobs report for October, 2015, I have my eyes on potential currency plays. I noted earlier, I am now anticipating a continued breakout for the U.S. dollar index. After looking at individual charts, I am most intrigued by the U.S. dollar versus the Japanese yen. USD/JPY is on the edge of a fresh breakout.

Source: FreeStockCharts.com

The top of the current trading range matches the last big breakout point that led USD/JPY to a multi-year breakout. If resistance holds, I will assume USD/JPY will eventually retest the bottom of the trading range.

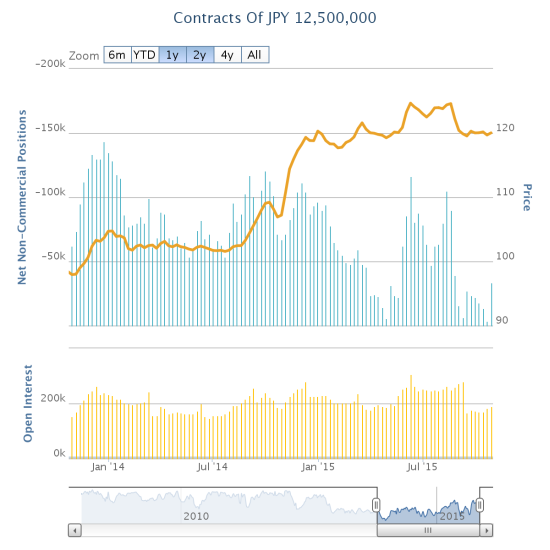

Here is a look at how speculators are positioned against the Japanese yen (FXY):

Source: Oanda’s CFTC’s Commitments of Traders

This chart shows that over the last two years, speculators have remained bearishly positioned against the Japanese yen. Those net short positions went into steep retreat as the August Angst unfolded. In the last week, traders have rushed back into (net) short positions. With traders apparently itching to reload on shorts, USD/JPY could skyrocket on a breakout.

Be careful out there!

Full disclosure: no position