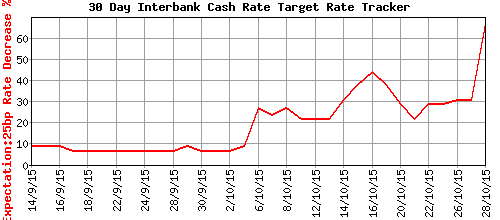

Australia’s persistently weak inflation data has now convinced the market that the Reserve Bank of Australia (RBA) is much more likely than not to cut interest rates at its November 3, 2015 meeting on monetary policy.

Source: The ASX RBA Rate Indicator

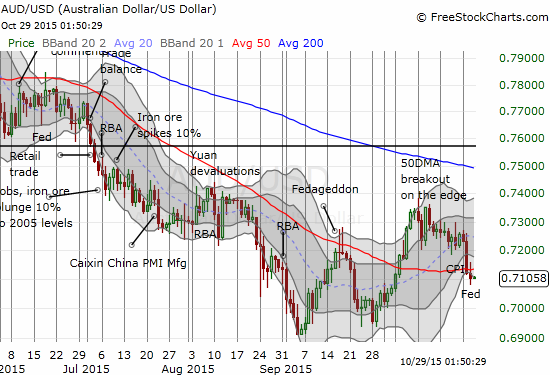

Combine this flip in market sentiment with the mirror image of the market pulling in the timing of a rate HIKE in the U.S., and the Australian dollar (FXA) finds itself firmly locked in the grip of policy divergence. This is a very bearish development for the currency and makes shorting the Australian dollar going into next week’s meeting even more attractive.

However, the market’s strong conviction also raises the stakes for the meeting. If the RBA fails to deliver a rate cut or even stays silent on its directional (downward) bias, the Australian dollar could experience a sharp, albeit temporary, relief rally. I am looking to stay short through the meeting.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: net short the Australian dollar