(This is an excerpt from an article I originally published on Seeking Alpha on October 14, 2015. Click here to read the entire piece.)

{snip}

This quote is the entirety of a terse and pointed press release that commodity giant Glencore (GLCNF) (GLNCY) delivered to calm market fears about the company’s business. This release came a day after the stock plunged 29% in the wake of analyst doubts about Glencore’s financial soundness. {snip}

{snip}

The press release worked as Glencore’s stock quickly recovered all its losses. {snip}

Source: Bloomberg.com

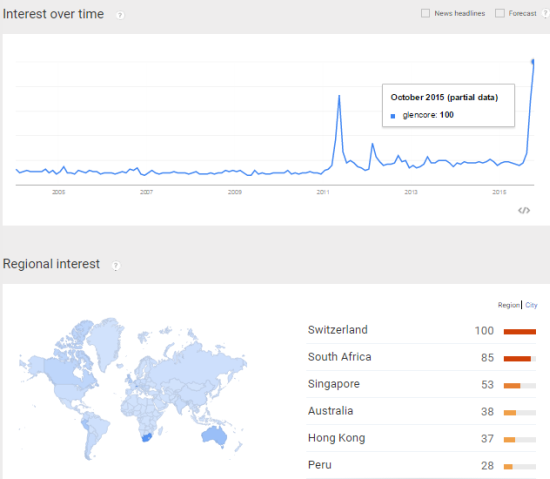

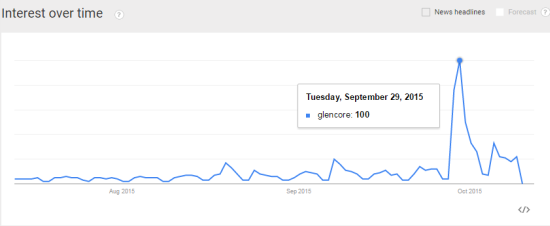

The news was big given Glencore’s size (now greatly diminished) and position in the commodity complex. Google trends indicates the relative magnitude of the surge of interest. The buzz on Glencore’s potential demise roared louder than the buzz surrounding its big splash onto the IPO market just as commodities were peaking in 2011.

Source: Google Trends

The combination of sharp price action and market news is signature for a major market extreme that signals the end of a move. In this case, Glencore looks like it has made a major bottom. In a Bloomberg interview, Jim Chanos even implied that he is finally ready to cover his short in Glencore.

{snip}

I am also not willing to declare that this is THE bottom given the Glencore incident is likely to be an early salvo of more churn to come. Many of us have seen this story before…{snip}

No matter how this drama actually unfolds, the price action, the Google trends, and Chanos all suggest together that sellers have exhausted themselves for now.

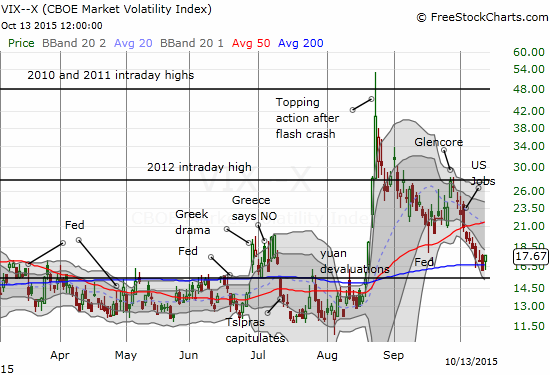

Interestingly, the burst of drama on Glencore coincided with some important market moves. {snip}

As the chart of the VIX shows, the weak jobs report was the final sweep. {snip}

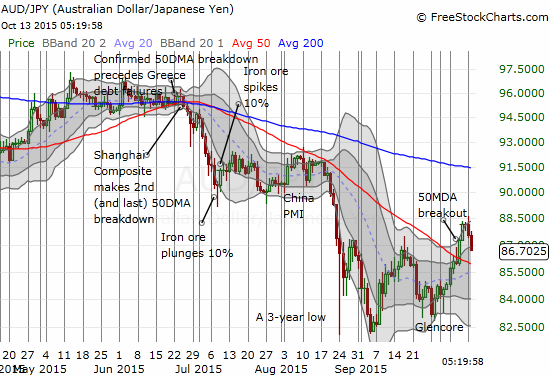

In an even more stark example of Glencore’s correlation with markets, the Australian dollar (FXA) – {snip} – traded sharply around the Glencore news. {snip}

{snip}

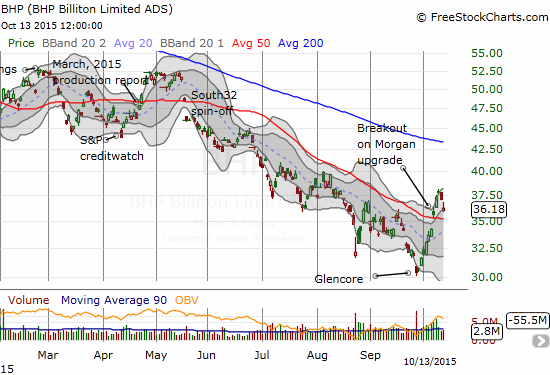

There are of course a lot of cross-signals and not everything is about Glencore…especially since Google trends suggest that Americans do not have this unfolding drama front and center on their radar. One important cross-current recently came from Morgan Stanley (MS).

{snip}

Source for equity charts: FreeStockCharts.com

Contrast this upgrade and market reaction to the prior week. Ironically enough, it was Morgan Stanley talking the exact opposite side of the commodity story. {snip}

…{snip}The absence of a collapse, which is the “good news” for Glencore for now, does not count as good news even under current conditions. My main point of optimism is that at least it seems we are finally closing in on some kind of true, washout moment that carves out a solid and sustainable bottom in many commodities. As seems so often the case these days, the final washout looks like it could involve some kind of credit/debt event. My eyes stay focused on Glencore.

(This is an excerpt from an article I originally published on Seeking Alpha on October 14, 2015. Click here to read the entire piece.)

Be careful out there!

Full disclosure: long put and call options on BHP, long RIO call options