When Meritage Homes (MTH) lowered guidance on September 9, 2015, the nation’s seventh largest homebuilder blamed several factors:

- A delay in closing homes. This was the most concerning explanation because the company provided no further details on it.

- Increased labor costs. These costs impacted margins. The problem was particularly acute in MTH’s major markets of Colorado and Texas where severe weather created a backlog of work for subcontractors. The good news on these pressures was a confirmation of the strong housing markets in those areas.

- Slower business than expected from newer divisions in the Southeast. This explanation was a bit mysterious but was explained better in an investor conference as slower than expected integration of new acquisitions. I cover the rest of the investor conference below.

This news was quite a turn from the way MTH bullishly started the year with a pre-announcement of exceptionally strong sales. The stock gapped down 8.9% on the latest news and was down even further for a bit.

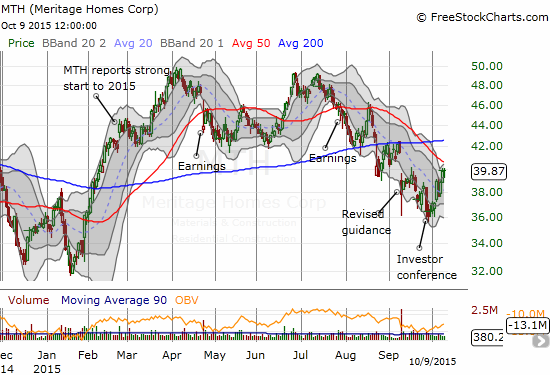

Source: FreeStockCharts.com

The chart above shows that MTH has started to recover from September’s earnings warning. The stock is now at a critical point as it trades just below the downtrending 50-day moving average (DMA) which has served as resistance since August. However, the stock may have bottomed right at the time of the Deutsche Bank 23rd Annual Leveraged Finance Conference on September 29 with a retest of the intraday low from the earnings warning. At the conference, MTH elaborated on its guidance and provided its outlook for the housing market. Importantly, MTH stuck by its bullish outlook and promised analysts that it will turn around the negative factors that drove the company to warn ahead of the conference.

Like all homebuilders, MTH believes that the housing market is still in the early stages of a recovery. The company juxtaposes very familiar housing data that is still barely off what would have been called recession levels in previous cycles versus the strong employment profile of the U.S. economy. I have increasingly heard that household formation is finally showing signs of life (I am still looking for the hard data!). MTH pointed to this development of “green shoots” over the past 3 to 4 quarters as support for its expectation of strong demand to come.

In particular, MTH has an “entry-level plus” strategy in preparation for what it sees as entry-level buyers with an older profile than typical entry-level buyers of the past. Delays in household formation mean that first-timers are older and looking for more home than 20-somethings are willing to accept. MTH called these bargain basement homes “doorbell and dishwasher optional.” Entry-level plus homes provide affordability through higher density building or lower priced lots in “emerging markets” which I assume are growing suburbs outside of the country’s major job centers.

The development of late-stage entry-level buyers could be one of the most important demographic developments for the housing market in the coming 10 years or more. It is a development that could confound housing bears to no end. Housing bears have tended to look at the poor household formation and homeownership data and assume that these are trends driving inexorably toward something north of zero. (I have covered this topic in several earlier pieces). It is at least as valid to look at today’s poor numbers and project out a growing source of pent-up demand. At some point, today’s young people will strive for the same kind of independence young Americans have always sought. Companies like MTH are preparing for this swell. As MTH said, the company does not believe America is going to become a nation of renters.

Here are some other bullet points from the investor conference including the short Q&A session at the end. In particular, see the commentary on Arizona at the end of these notes:

- MTH operates in 21 markets across 9 states. Two-thirds of its customers are move-up buyers.

- MTH was the #13 builder in 2005 based on orders and closings. It has since climbed to #7 on acquisitions. In the current growth cycle, MTH has made 2 acquisitions that have provided expansion into 6 markets.

- Houston is experiencing “some softness” but MTH sees long-term growth in Texas. (Me: This is a consistent claim from homebuilders)

- The only reason housing collapsed after the last 14-year cycle was a change in government policy. (Me: Huh?!? I would LOVE to get more detail on that! I have written to investor relations to see what I can get.)

- Young people will “manage through” the weight and disappointment of student debt. MTH cited very familiar statistics on the current load of student debt which the company admits has contributed to delays in the recovery for first-time homebuyers. For more on this topic, see, for example my 2014 piece “Growing Stalemate: Housing Starts, Affordability, and Sentiment Versus Student Debt.”

- The company is not interested in the rental business.

- MTH has built homes in the Phoenix area for 30 years. About 11-12% of its entire business. The active adult business in Tuscon bumps that share up to 15 or 16%. MTH is Arizona’s second largest builder.

- Arizona has had a bigger hangover than other states from the housing downturn and has not recovered as fast as expected. The state had 15-16K for-sale housing starts this year. The 30-year historical average is 25-30K. At the peak of the market, this number got to 60K (me: wow!).

- The immigration issue has hit Arizona hard. About 300K Hispanics have left the state. Job growth has lagged the national average. Arizona has not been able to recruit companies from the Fortune and faces effective competition from Texas, Colorado, the Carolinas, and Florida. With a new governor promising new policies, MTH is confident Arizona will grow again.

Be careful out there!

Full disclosure: long call options on MTH